CMC Markets Australia to cease offering Countdowns

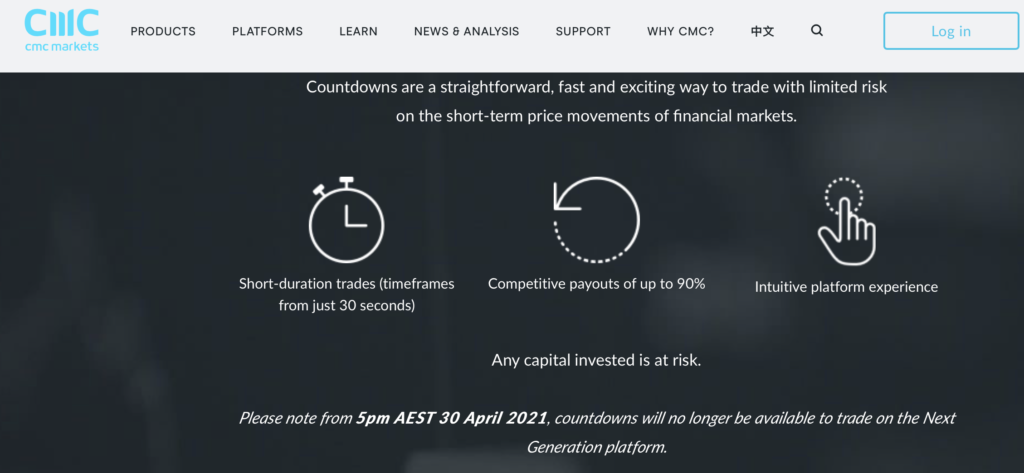

Online trading company CMC Markets has posted a short notice for its Australian clients, informing them that from 5pm AEST 30 April 2021, Countdowns will no longer be available to trade on the Next Generation platform.

Countdowns are fixed-odds trades based on whether the settlement price of a product will be above or below the current Countdown price at the end of a range of short-term timeframes.

Let’s note that the announcement about the end of the offering of Countdowns is released shortly after the Australian Securities and Investments Commission (ASIC) said it would ban the offering of binary options to retail investors.

The ban will take effect from Monday 3 May 2021 after ASIC found that binary options have resulted in and are likely to result in significant detriment to retail clients.

CMC Markets has been compliant with recently introduced changes to rules for CFD trading in Australia, which came into effect on March 29, 2021.

The biggest change is tightening leverage ratio limits. The new rules give all retail traders margin close-out protection. This change means greater protection for you when trading, by limiting your losses when market movements leave your position exposed.

For greater protection, specifically for CMC Markets clients the broker will close your open positions automatically until your net equity is back above 70% of the margin required for remaining open positions.

CMC Markets was already using margin close-out protection. This means there was no margin close-out protection changes for CMC Markets retail clients from 29 March 2021.

Anonymous

April 14, 2021 @ 9:25 am

2.5