| Broker name: | Exness |

| Broker logo: |  |

| Founded: | 2008 |

| Headquarters address: | 1 Siafi Street, Portobello Office 401, Limassol 3042, Cyprus |

| Exness Branded Offices in: | Cyprus, United Kingdom, South Africa, Seychelles, Curaçao, British Virgin Islands. Offices located in Cyprus and the United Kingdom do not provide services to retail clients. |

| Contact Tel: | +357 25 245 730 |

| Contact email: | support@exness.com |

| Website: | https://www.exness.com |

| CEO: | Petr Valov |

| Deposit currency: | We offer many local payment solutions as well as BTC and USDT crypto solutions. |

| Account currency: | “AED”, “ARS”, “AUD”, “AZN”, “BDT”, “BHD”, “BND”, “BRL”, “CAD”, “CHF”, “CNY”, “EGP”, “EUR”, “GBP”, “GHS”, “HKD”, “HUF”, “IDR”, “INR”, “JOD”, “JPY”, “KES”, “KRW”, “KWD”, “KZT”, “MAD”, “MXN”, “MYR”, “NGN”, “NZD”, “OMR”, “PHP”, “PKR”, “QAR”, “SAR”, “SGD”, “THB”, “UAH”, “UGX”, “USD”, “UZS”, “VND”, “XOF”, “ZAR”. |

| Execution model: | Instant and Market |

| Website languages: | 14 |

| Minimum deposit: | $10 |

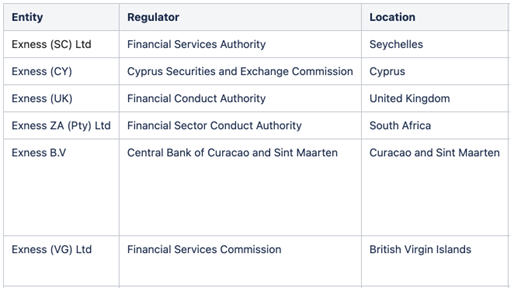

| Regulators: |  |

| Trading Platforms: | MT4, MT5, MT4 WebTerminal, mobile (iOS & Android) |

| Trading Volumes: | $1.9 trillion (average monthly volumes 2022 Jan-Apr) |

| Account activation time: | Standard, Standard Cent – instant (no initial deposit requirement)

Pro, Raw Spread, Zero – instant once a client makes the initial deposit requirement. |

| Sign-up bonus: | No |

| Bonus programs, Rewards: | Currently, Exness does not provide any bonus programs as it is not in line with Exness’ core ideological values. Some kind of reward may be provided from time to time based on certain campaign conditions. |

| Referral commission: | CPA, CPL and IB partner schemes |

| The number of active traders: | Over 260K |

| Account Types: | Standard Cent, Standard, Pro, Raw Spread, Zero. |

| Islamic Account: | Yes, swap-free. |

| Prohibited countries: | The United States of America, American insular areas (American Samoa, Baker Island, Guam, Howland Island, Kingman Reef, Northern Mariana Islands, Midway Islands, Wake Island, Palmyra Atoll, Jarvis Island, Johnston Atoll, Navassa Island, United States Minor Outlying Islands), Vatican City, Puerto Rico, Marshall Islands, US Virgin Islands).

Exness also do not accept residents of the following countries: New Zealand, Canada, Australia, Vanuatu, Seychelles, Russia, Israel, Iraq, Syria, Yemen, Palestinian Territory, Iran, North Korea, Malaysia, all EU countries, Gibraltar, Curacao, the United Kingdom and others. However, we accept nationals of these countries if they live in any allowed country. |

| Server Location: | Amsterdam, Hong Kong, Singapore, Johannesburg, Miami |

| Access US Clients: | No |

| Products offered: | Forex, metals, cryptocurrencies, energies, indices, stocks |

| Demo trading account offered: | Yes |

| Deposit and withdrawal methods accepted: | EPS, cryptocurrency, bank cards, local payment systems, internal transfers |

| Number of currency pairs: | 97 |

| Number of cryptos: | 35 |

| Maximum leverage: | 1:2000 |

| Spreads: | Spread depends on account type and instrument. Spreads are always floating. Because of this, the spreads in the above table are averages based on the previous trading day. For live spreads, please refer to the trading platform.

Exness’ lowest spreads are on Zero account and remain fixed at 0.0 pips for 95% of the trading day. |

| Minimum lot size trading volume: | Depends on the instrument |

| Maximum lot size: | Depends on the instrument |

| Withdrawal processing time: | Depends on the payment system. May vary based on the payment provider’s processing time. Starts from instant for the majority of payment systems. |

| Margin call: | 30% for Pro, Zero, Raw Spread

60% for Standard and Standard Cent |

| Stop out: | 0% and custom stop out feature |

| Trust Account Management: | No, however, we do offer products that are similar to TAM such as Social Trading. You can find the Social Trading App download links and also strategies from this link: https://social-trading.exness.com/ |

| Sponsorships: | None at the moment |