Plus500 registers growth in client numbers in Q1 2021

CFDs broker Plus500 Ltd (LON:PLUS) today issued a trading update for the three months ended 31 March 2021.

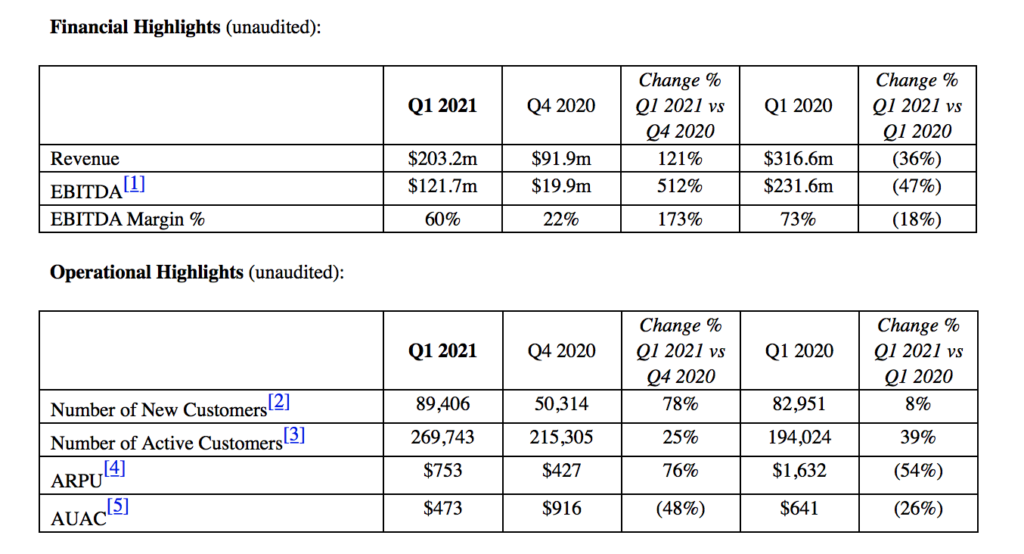

Group Revenue in Q1 2021 was $203.2 million, up from Q4 2020 ($91.9m) but markedly down from a year earlier (Q1 2020: $316.6m).

Group EBITDA in Q1 2021 was $121.7 million. The result was much lower than a year earlier (Q1 2020: $231.6m) but better than in Q4 2020 ($19.9m).

Customer Income remained robust at $221.5m in the quarter. The result was lower than in Q1 2020 ($233.5m). It was, however, better than in Q4 2020 ($200.6m), in line with Plus500’s earlier guidance.

The Company on-boarded a total of 89,406 New Customers in the quarter, up 8% compared with Q1 2020 and up 78% compared with Q4 2020 (Q1 2020: 82,951, Q4 2020: 50,314).

Plus500 achieved a record quarterly number of Active Customers of 269,743 during Q1 2021, an increase of 39% compared with Q1 2020 and an increase of 25% compared with Q4 2020 (Q1 2020: 194,024, Q4 2020: 215,305), driven by the Company’s efforts and investment in customer retention. ARPU was $753 in Q1 2021 (Q1 2020: $1,632, Q4 2020: $427).

AUAC reduced from the prior year and the prior quarter to $473 in Q1 2021 (Q1 2020: $641, Q4 2020: $916). The Company continues to expect that AUAC will rise steadily over time as the Company’s customer profile continues to shift to higher value customers.

Importantly, Plus500 commented on the recent regulatory changes implemented by the Australian Securities & Investment Commission (ASIC) for the CFD industry in Australia which came into force on 29 March 2021.

Plus500 says:

“While it remains at an early stage, the Board believes that the anticipated impact on the Group’s revenues of these regulatory changes is already incorporated in current compiled analysts’ consensus forecasts for Plus500. The Board continues to assess the impact of these new regulations on the business”.

In terms of outlook, the Board expects FY 2021 revenue and EBITDA to be moderately ahead of current compiled analysts’ consensus forecasts. For FY 2021, revenue will be driven through further underlying strength of Customer Income, while EBITDA will be supported by Plus500’s lean, flexible cost base and efficient business model.