CMC Markets issues guidelines to Australian traders on new CFD rules

Online trading company CMC Markets has issued a quick guide to its Australian retail clients to help them adjust to the new rules on contracts for difference (CFDs).

The Australian Securities and Investments Commission (ASIC) has outlined new rules for CFD trading in Australia, which are due to come into effect on March 29, 2021. These new rules may affect the way Australian retail clients of the broker trade.

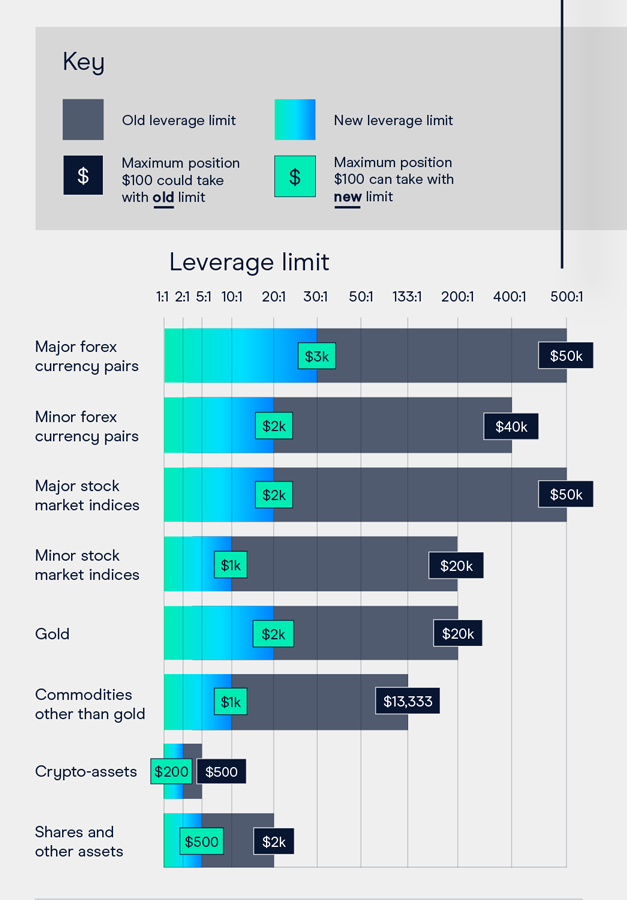

The biggest change is tightening leverage ratio limits. The new maximum leverage ratios for CFD trades will be:

The new rules give all retail traders margin close-out protection. This change means greater protection for you when trading, by limiting your losses when market movements leave your position exposed.

If the total funds in your CFD account fall below 50% of the margin required for all your open CFD positions, your provider will be required to begin closing open CFD positions. This will happen as soon as market conditions allow.

For greater protection, specifically for CMC Markets clients the broker will close your open positions automatically until your net equity is back above 70% of the margin required for remaining open positions.

CMC Markets is already using margin close-out protection. This means there will be no margin close-out protection changes for CMC Markets retail clients from 29 March 2021.

Also, under the new rules retail traders will no longer be able to lose more than their initial deposit. The negative balance protection is like a safety net that catches the traders if the market turns against their position too quickly for the margin close-out orders to slow their fall.

Finally, there are new restrictions in how providers promote and induce clients to open a CFD account, trade CFDs and deposit funds/property in relation to a CFD.

The number of Australians trading CFDs has grown rapidly in recent years. The nature and complexity of CFDs means they are not for everyone. ASIC, Australia’s corporate regulator, has moved to limit some of the risks traders can experience with CFDs.

CMC Markets comments:

“Fair outcomes for clients have always been a focus for us and we welcome the opportunity to work with ASIC to ensure the industry acts in the best interests of Australian traders. Similar measures have previously been introduced in major overseas markets, including the UK and EU”.

Let’s note that CMC Markets offers professional accounts too. Australian clients of the brokerage may be eligible to apply for a CMC Markets Pro account. Pro account holders enjoy personal service, additional perks and access to reduced margins.