Capital.com halts onboarding of UK clients

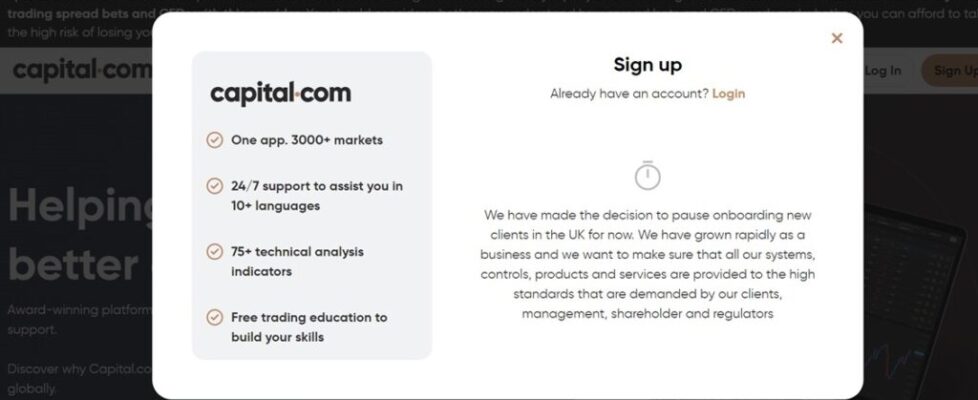

London based Retail FX and CFDs broker Capital.com has posted a note on its website in the UK that it has made the decision to pause onboarding new clients in the UK, for now. The note states that the company has “grown rapidly” as a business, and Capital.com wants to make sure that all its systems, controls, products and services are provided to the high standards that are demanded by clients, management, shareholder and regulators.

The move applies only to clients of Capital.com’s UK arm, Capital Com (UK) Limited, which is regulated by the Financial Conduct Authority (FCA), under registration number 793714. Capital.com appears to still be onboarding clients elsewhere in other group entities. The company in the UK does seem to be providing regular services to existing clients of Capital.com UK.

The move by Capital.com is a curious one, as the company has staffed up big-time over the past two years (mainly) in its newly refurbished London headquarters, with many of the new senior hires being ex IG Group staffers. The changes began in early 2022 when Capital.com brought on board former IG Group chief Peter Hetherington as CEO, although Mr. Hetherington left the company late last year and was replaced by Kypros Zoumidou, who was previously Commercial Director International at IG.

Capital.com operates several licensed subsidiaries involved in online brokerage in the UK, Australia, and Cyprus. The company, and its sister brand Currency.com are controlled by Victor Prokopenya, a Belarusian lawyer and computer scientist living in London.

FNG spoke to an official spokesperson for Capital.com, who explained:

FNG spoke to an official spokesperson for Capital.com, who explained:

“Capital.com has made the strategic decision to temporarily pause new client onboarding in the UK. This is to ensure we continue to deliver an uncompromised level of service to our existing clients in the UK as we experience rapid and unprecedented growth in new and emerging markets.

This temporary pause will allow us to ensure all our systems, controls, products and services meet the stringent standards demanded by our valued clients, management, shareholders and regulators. This is a proactive measure that aligns with our long-term vision of delivering sustainable growth and operational excellence.

During this time, people resident in the UK who are not existing clients will not be able to open a new account with Capital Com UK Limited. All existing UK clients with an active account will not be affected and can continue to deposit or withdraw funds, add additional sub-accounts and trade as normal. Capital.com continues to operate a full service in all other markets.

We remain committed to supporting our clients and expect to start onboarding new clients again in the UK in due course.”

March 15, 2024 @ 11:16 am

so what does peter hetherington know that the rest of us don’t?