Robinhood shares see 14% one-week drop in wake of coming PFOF ban

The SEC wants a more competitive alternative to PFOF, where client orders are auctioned off or competed for in an orderly fashion.

The SEC wants a more competitive alternative to PFOF, where client orders are auctioned off or competed for in an orderly fashion.

Robinhood and Citadel Securities claim that traders have tried to manufacture an antitrust conspiracy where none exists.

ASIC has amended the prohibition on payment for order flow (PFOF) to address certain regulatory gaps.

Robinhood argues that traders’ claim about its alleged aiding and abetting the market makers should be dismissed.

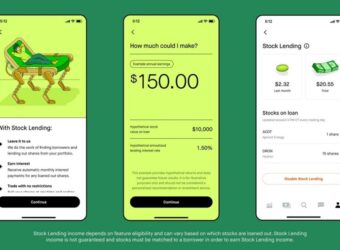

Robinhood Markets derived most of its revenues from PFOF, with Citadel Securities accounting for 22% of the total.

Traders in Florida sue Robinhood Financial over its payment for order flow arrangements with Citadel, Apex, Wolverine and Virtu.

Which online broker is running anti payment-for-order-flow ads? How did eToro’s preliminary Q4 results look, after a weak Q3?

Most retail brokers sell their orders to market makers, nearly 50% of orders are executed away from exchanges.

Saxo explains that it does not use Payment For Order Flow (PFOF) but instead executes equity orders using SOR technology.

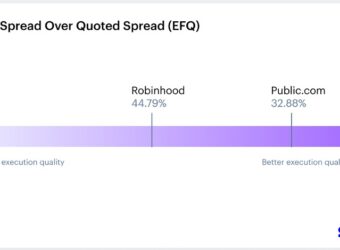

Public.com claims it delivers better execution quality to customers than peer firms like Robinhood that accept PFOF from market makers.