Robinhood, Citadel argue antitrust complaint against them should be dismissed

About a fortnight after a group of traders reiterated their antitrust conspiracy claims against Robinhood and Citadel Securities, the defendants have filed their response with the Florida Southern District Court.

The antitrust complaint is a part of a multidistrict litigation (MDL) related to the January 2021 short squeeze. According to the plaintiffs, this case involves a collusive agreement to restrict individual investors from exercising control over their trades and trading accounts. Robinhood and Citadel are accused of having hatched an anticompetitive scheme to restrict Retail Investors’ access to specific securities in the stock market, to suppress the prices of these securities, and to prevent the market from operating freely and fairly.

The complaint further alleges that Robinhood and Citadel entered into an illegal agreement to implement this scheme and committed a series of overt acts in furtherance of the conspiracy. The agreement was implemented, effective and caused its intended purposes, causing hundreds of millions in dollars in damages to the Plaintiffs and the Class they represent.

On Friday, March 25, 2022, Robinhood and Citadel responded to the revived claims. According to the defendants, for more than a year, Plaintiffs have tried to manufacture an antitrust conspiracy where none exists.

Robinhood and Citadel insist that just as the core of Plaintiffs’ theory remains the same, so do the fatal flaws. Plaintiffs are said to have failed to identify any new or different factual allegations in their Amended Antitrust Complaint to render this theory any less implausible than it was when Plaintiffs alleged it in the complaint the Court previously dismissed.

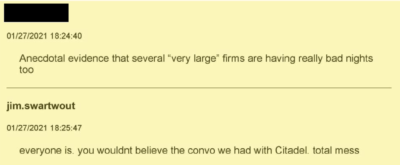

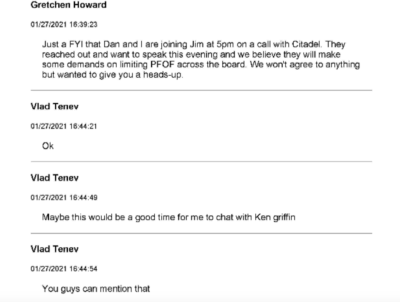

First, Plaintiffs point in the Amended Antitrust Complaint to the very same set of communications that the Court previously concluded are “vague and ambiguous emails between two firms in an otherwise lawful, ongoing business relationship” that are not “enough to nudge Plaintiffs’ claims across the line from conceivable to plausible.”

Plaintiffs do not contest, or even attempt to address, the fact that they continue to rely on the same communications that the Court has already found insufficient to support an inference of conspiracy. Robinhood and Citadel say that the plaintiffs also rely on the same circumstantial evidence as before.

Most fundamentally, the defendants note that the plaintiffs cannot overcome the obvious alternative explanation for the purchase limitations: that Robinhood acted in response to the $3 billion collateral call it received from the NSCC on the morning of January 28, 2021, rather than because of some unlawful agreement with Citadel Securities.

Second, having now alleged a vertical (rather than horizontal) conspiracy in the Amended Antitrust Complaint, Plaintiffs fail to plead the harm to competition that the rule of reason requires for such a claim. Specifically, the plaintiffs are said to have failed to plead harm to competition in either of the two product markets that they allege—the alleged “upstream” PFOF Market in which Citadel Securities competes, or the alleged “downstream” No-Fee Brokerage Trading App Market in which Robinhood competes.

Plaintiffs’ alleged harm—“that the stock prices for the Relevant Securities did not appreciate further”—concerns the trading prices of the Relevant Securities, and thus is felt in the supposed market for the Relevant Securities, not either of the markets in which Plaintiffs allege Defendants compete. In an effort to avoid application of the rule of reason, Plaintiffs now assert in their Opposition, for the first time, a newly constructed framework in which Citadel Securities and Robinhood are horizontal competitors in a combined “market for securities trading services.”

This is contrary to the Amended Antitrust Complaint, where Plaintiffs allege that “market makers and brokerages operate at two different levels,” and “Citadel (a market maker) operates in a relevant market upstream of that in which Robinhood (a brokerage) operates.”

Plaintiffs’ newfound characterization also makes no sense, as antitrust markets are defined by demand substitutability, the defendants say. A consumer could not go to Citadel Securities to obtain an alternative to Robinhood’s brokerage services, nor could a market participant obtain Citadel Securities’ market-making services from Robinhood.

Therefore, to the extent that Plaintiffs plead any conspiracy, they plead a vertical conspiracy between parties operating in different markets, for which the rule of reason applies. And because Plaintiffs fail to plead harm to competition in either of the alleged markets in the Amended Antitrust Complaint, Plaintiffs are said to have failed to state a claim under the rule of reason.

Furthermore, the defendants argue that the federal securities laws preclude Plaintiffs’ antitrust claim. In opposition, Plaintiffs argue that the federal securities laws do not address collusive conduct—but the crux of Plaintiffs’ claims is purported manipulation of the trading prices of the Relevant Securities (that is, the stocks of companies like Gamestop), which is in the heartland of federal securities regulation. Plaintiffs cannot escape the scope of the federal securities laws by labeling their claim as an antitrust conspiracy.

Robinhood and Citadel conclude that, after more than a year of litigation, review of thousands of documents from the alleged conspirators and three attempts to plead a cognizable antitrust claim, Plaintiffs still have failed adequately to plead an unlawful agreement in restraint of trade. Given the ample opportunity this Court has already provided Plaintiffs, the Amended Antitrust Complaint should now be dismissed with prejudice, the defendants say.