FCA sends Dear CEO letter warning of AML failings

All Annex 1 firms should assess their financial crime controls against the common weaknesses the FCA has found within the next six months.

All Annex 1 firms should assess their financial crime controls against the common weaknesses the FCA has found within the next six months.

Aegis Investments failed to conduct annual independent testing of the firm’s AML compliance program between 2011 and 2020.

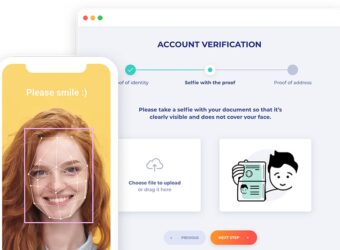

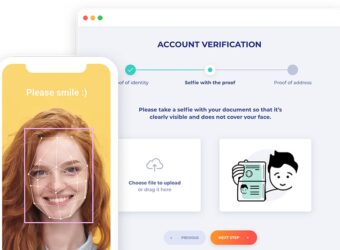

The PayPugs-Huntli partnership solves the problem of obtaining a trusted fraud prevention system that doesn’t disturb customer experience.

Andrew Feist – then Interactive Brokers’ AMLCO – failed to establish a reasonably designed AML program at the firm.

Hong Kong’s SFC has imposed a fine of $3.6 million on Mason Securities Limited (MSL), formerly known as GuocoCapital Limited (GCL).

AML/CFT compliance officers need to have a sufficient level of seniority with powers to propose all necessary or appropriate measures.

Sumsub has signed a number of deals recently integrating its technology with platform providers to Retail FX brokers.

FIS AML Compliance Hub is the first in a new line of AI-based solutions from FIS for capital markets firms.