Deutsche Börse’s 360T generates €24.2m in revenues in Q3 2020

The foreign exchange segment of Deutsche Börse AG, 360T saw a slight decrease in revenues in the third quarter of 2020, as indicated by Deutsche Börse’s latest quarterly statement.

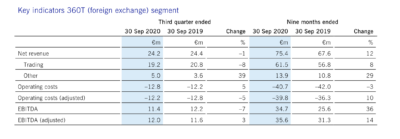

Deutsche Börse’s 360T reported €24.2 million in revenues in the third quarter of 2020, down 1% from a year earlier. The platform reported EBITDA of €11.4 million, down 7% from the equivalent period a year earlier.

Across all segments, Deutsche Börse Group’s net revenue for the third quarter of 2020 amounted to €707.5 million, down 4% from a year earlier. Despite unfavourable market conditions, the Group achieved secular net revenue growth of 4%, on the back of growth initiatives in the Eurex (financial derivatives) segment, a rise in volumes in the IFS (investment fund services) segment, as well as from increased custody business in the Clearstream segment (post-trading).

Furthermore, net revenue attributable to consolidation effects made a positive 2% contribution to growth, mostly resulting from the Axioma acquisition in 2019.

Given the lower trading activity in financial and power derivatives and decreasing net interest income from banking business – the cyclical factors had a negative effect of 9% on growth.

Deutsche Börse Group’s adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) decreased by 7%, to €431.4 million (Q3/2019: €461.7 million). Adjusted depreciation, amortisation and impairment losses totalled €62.3 million during the quarter (Q3/2019: €53.6 million).

At €252.7 million, net profit for the period attributable to Deutsche Börse AG shareholders was down 11% compared to the same quarter of the previous year (Q3/2019: €282.9 million).

Gregor Pottmeyer, Chief Financial Officer of Deutsche Börse AG, commented on the results:

“The cyclical development had a material adverse impact on our net revenue in the third quarter. On a positive note, however, Deutsche Börse was once again able to achieve secular net revenue growth. Amongst other factors, subject to an increase of market activity in the fourth quarter, we still consider our full-year targets to be achievable.”

Despite the weaker development in the third quarter, the Group’s guidance for 2020 remains unchanged at around €1.20 billion adjusted consolidated net profit. Amongst other factors this is subject to an increase of market activity in the fourth quarter.