CME Group reports lower revenues in Q3 2020

Derivatives marketplace operator CME Group Inc (NASDAQ:CME) today posted its financial report for the three months to end-September 2020, with profits and revenues down from a year earlier.

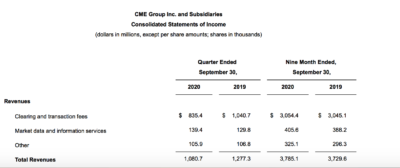

- The company reported revenue of $1.1 billion for the third quarter of 2020, down from $1.3 billion registered in the corresponding period a year earlier.

- Operating income was $525 million in the third quarter of 2020, compared with $685.2 million a year earlier.

- Net income was $412 million, down from $636 million in the third quarter of 2019.

- Diluted earnings per share for the third quarter of 2020 were $1.15.

- On an adjusted basis, net income was $495 million and diluted earnings per share were $1.38.

Third-quarter 2020 average daily volume (ADV) was 15.6 million contracts, including non-U.S. ADV of 4.4 million contracts. This was lower than 20.2 million contracts in the third quarter of 2019, and down from 17.6 million contracts in the second quarter of 2020.

Across segments, let’s note that Clearing and Transaction fees revenue for the third quarter of 2020 totaled $835.4 million. The total average rate per contract was $0.716. Market data revenue totaled $139.4 million for third-quarter 2020.

As of September 30, 2020, CME had approximately $1.5 billion in cash (including $166 million deposited with Fixed Income Clearing Corporation (FICC) and included in other current assets) and $3.4 billion of debt.

The company paid dividends during the third quarter of $304 million. The company has returned approximately $14.1 billion to shareholders in the form of dividends since the implementation of the variable dividend policy in early 2012.

CME Group Chairman and Chief Executive Officer Terry Duffy commented:

“Despite the many challenges created by the ongoing pandemic, our metals, equities, agriculture and data services businesses showed strong performance during the third quarter. Likewise, we continued to innovate amid the extreme uncertainty, announcing a number of new products and services across asset classes, including Micro E-mini options and Nasdaq Veles California Water Index futures. In Q4, we remain focused on adding new value through the migration of BrokerTec onto CME Globex later this year, as well as providing risk management tools to help our global clients as they continue to navigate through this difficult economic environment.”