Institutional FX volumes slow 11% in April 2022 despite strong last two weeks

Following what was a very strong Q1 for the leading institutional eFX players – with some setting volume records – things have slowed down somewhat in April 2022 as we head into Q2.

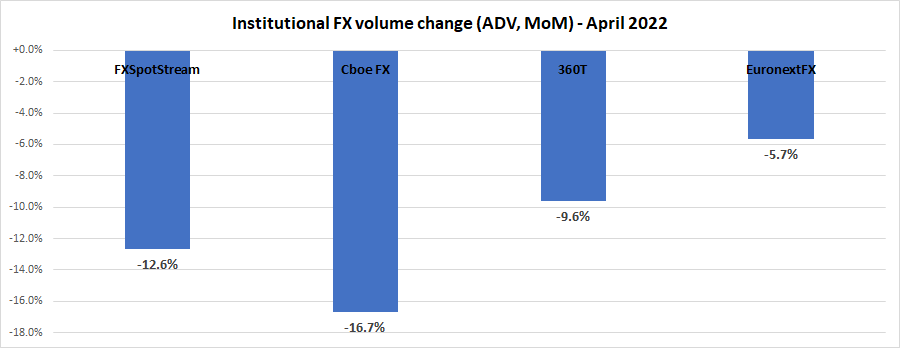

Overall, trading volumes at the institutional ECNs surveyed – FXSpotStream, Cboe FX, EuronextFX and 360T – were down by an average of 11% in April as compared to March, with all players reporting a decrease in activity.

However, the decline is somewhat misleading.

First, it comes against a backdrop of much stronger-than-usual activity in the Q1 months, as noted above.

And when looking closer at the data, April was a story of two halves with April 1-15 being fairly slow, aided somewhat by the onset of the Easter, Ramadan, and Passover holiday seasons. However activity in the second half of April picked up, and even exceeded March’s levels at some ECNs.

For example Cboe FX, which enjoyed its second best ever month in March 2022 with average daily volumes of $44.44 billion, saw ADVs of $37.01 billion in April, although in the second half of April it was $43.72 billion (and just $30.90 billion in the first half).

Cboe FX (formerly HotspotFX)

- April 2022 average daily volumes were $37.01 billion, -16.7% from March’s $44.44 billion.

EuronextFX (formerly FastMatch)

- April 2022 ADV $24.63 billion, -5.7% from March’s ADV of $26.11 billion.

FXSpotStream

- FXSpotStream’s ADV YoY (April22 vs April‘21) increased 25.76% to USD61.250 billion.

- FXSpotStream’s ADV MoM (April‘22 vs March’22) decreased 12.64%, following a record high ADV in March at USD70.1 billion.

- FXSpotStream’s Overall Volume YoY (April‘22 vs April‘21) increased 20.04% to USD1.286trillion, the 4th month in a row with supported volume well over 1 Trillion.

- FXSpotStream’s ADV YTD (Jan-April’22) is USD62.051billion, an increase of 22.61% compared to the same period last year.

360T

- Average daily volumes (ADV) at 360T came in at $25.76 billion in April 2022, down 9.6% from March’s $28.50 billion.