FX week in review: USGFX CEO out, FXOpen acquires, LMAX and FXCM results

While many (if not most) Retail and Institutional FX brokers have been putting out stellar and often surprisingly so financial results, two industry stalwarts – FXCM and LMAX – released financial updates which were not quite as good as might be expected, although for very different reasons. More on that below.

FX industry consolidation continued, with FXOpen preparing for Brexit by buying CySEC licensed AMB Prime.

The USGFX bankruptcy saga down under continued to unfold, with longtime CEO Shay Zakhaim leaving the company.

Other executive moves were reported involving ADSS, Equiti Group, Admiral Markets, Gallant Exchange, oneZero, and CMC Markets.

And once again, most if not all of the week’s key stories appeared exclusively on FNG.

Some of the top forex industry news items to appear on the pages of FNG this week included:

Exclusive: FXCM UK revenues down 72% in 2019, loss $1M. FNG Exclusive… FNG has learned via regulatory filings that Forex Capital Markets Limited, the FCA-licensed, UK arm of retail forex broker FXCM, saw a steep 72% decline in Revenues in 2019 leading to a net loss of $1.0 million for the year. Trading volumes fell to $45 billion monthly in 2019 at FXCM UK, from $92 billion monthly in 2018 and $139 million per month in 2017. FXCM UK is the main operating subsidiary of FXCM, so we believe that these results are indicative of what occurred overall at FXCM globally in 2019.

Exclusive: FXCM UK revenues down 72% in 2019, loss $1M. FNG Exclusive… FNG has learned via regulatory filings that Forex Capital Markets Limited, the FCA-licensed, UK arm of retail forex broker FXCM, saw a steep 72% decline in Revenues in 2019 leading to a net loss of $1.0 million for the year. Trading volumes fell to $45 billion monthly in 2019 at FXCM UK, from $92 billion monthly in 2018 and $139 million per month in 2017. FXCM UK is the main operating subsidiary of FXCM, so we believe that these results are indicative of what occurred overall at FXCM globally in 2019.

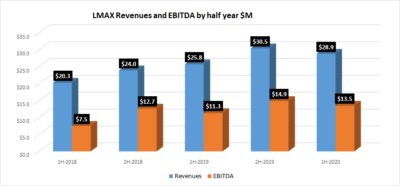

LMAX reports 5% Revenue decrease in 1H-2020. LMAX Group, which operates institutional execution venues for FX and crypto currency trading, has come out with a statement about its results from the first half of 2020. While LMAX reported what it calls “record results” for the six months ended 30 June 2020 (which we believe they got to by comparing 1H-2020 to 1H-2019), our analysis at FNG shows that Revenue and Profits actually declined slightly at LMAX during 1H-2020, as compared to the second half of 2019.

LMAX reports 5% Revenue decrease in 1H-2020. LMAX Group, which operates institutional execution venues for FX and crypto currency trading, has come out with a statement about its results from the first half of 2020. While LMAX reported what it calls “record results” for the six months ended 30 June 2020 (which we believe they got to by comparing 1H-2020 to 1H-2019), our analysis at FNG shows that Revenue and Profits actually declined slightly at LMAX during 1H-2020, as compared to the second half of 2019.

Exclusive: CEO Shay Zakhaim leaves USGFX, UK entity says “unaffected”. FNG Exclusive… Continuing our exclusive coverage of the surprise bankruptcy filing of Australian Retail FX and CFDs broker USGFX, FNG has learned that the company’s longtime CEO Shay Zakhaim has ended his tenure with the company. Mr. Zakhaim currently lists his occupation as “CEO, Capital Markets Professional, Regulatory Consulting”, marking the end of his tenure with the company he has led since 2014 as of July 2020. USGFX acts as front-of-shirt sponsor of Sheffield United FC, recently completing the first year of a three-year, multi million dollar sponsorship agreement between the two sides.

Exclusive: CEO Shay Zakhaim leaves USGFX, UK entity says “unaffected”. FNG Exclusive… Continuing our exclusive coverage of the surprise bankruptcy filing of Australian Retail FX and CFDs broker USGFX, FNG has learned that the company’s longtime CEO Shay Zakhaim has ended his tenure with the company. Mr. Zakhaim currently lists his occupation as “CEO, Capital Markets Professional, Regulatory Consulting”, marking the end of his tenure with the company he has led since 2014 as of July 2020. USGFX acts as front-of-shirt sponsor of Sheffield United FC, recently completing the first year of a three-year, multi million dollar sponsorship agreement between the two sides.

FXOpen prepares for Brexit with acquisition of Cyprus FX broker AMB. Global retail FX and CFDs broker FXOpen has taken a further step in its preparations for Brexit and the possible end of EU-UK license passporting. Like a number of FX brokers with an FCA licensed entity but lacking one somewhere in the EU, FXOpen rectified that situation by acquiring one via the purchase of Cyprus CIF-licensed AMB Prime Ltd (formerly known as Valutrades CY Ltd). FXOpen said that the new European entity will operate under the name FXOpen EU, and has received regulator permission to commence operations on August 17, 2020.

FXOpen prepares for Brexit with acquisition of Cyprus FX broker AMB. Global retail FX and CFDs broker FXOpen has taken a further step in its preparations for Brexit and the possible end of EU-UK license passporting. Like a number of FX brokers with an FCA licensed entity but lacking one somewhere in the EU, FXOpen rectified that situation by acquiring one via the purchase of Cyprus CIF-licensed AMB Prime Ltd (formerly known as Valutrades CY Ltd). FXOpen said that the new European entity will operate under the name FXOpen EU, and has received regulator permission to commence operations on August 17, 2020.

In other executive moves reported this week at FNG:

-

-

- Exclusive: Hormoz Faryar rejoins ADSS to head institutional sales

- oneZero adds Xenfin veteran Jamie Rose to expand UK and Europe

- CMC Markets adds Contino exec Brendan Foxen as CTO

- Admiral Markets adds Victor Gherbovet to its Management Board

- Exclusive: Former Nasdaq CEO Rick Beaman joins Gallant Exchange as President

- First Derivatives adds Cloudflare CFO Thomas Seifert to its board

-