Exclusive: FXCM UK revenues down 72% in 2019, loss $1M

FNG Exclusive… FNG has learned via regulatory filings that Forex Capital Markets Limited, the FCA-licensed, UK arm of retail forex broker FXCM, saw a steep 72% decline in Revenues in 2019 leading to a net loss of $1.0 million for the year.

FXCM UK’s revenues of $16.7 million in 2019 were down from $58.8 million in 2018, and from $78.0 million in 2017. The company said the drop was due to a number of factors, including a reduced number of clients, reduced client activity, lower currency volatility, and what it called a “challenging trading environment” after regulators The FCA and ESMA limited leverage which brokers like FXCM could supply traders in the UK and the EU as of August 2018.

Client cash held by FXCM UK actually rose, totaling $232.5 million at year end 2019, versus $224.0 million in 2018. FXCM said that was due to some higher value clients, and the higher margin requirements of customers following the FCA’s and ESMA’s imposition of lower leverage caps (i.e. higher margin requirements) on CFD trading, as noted above.

Trading volumes fell to $45 billion monthly in 2019 at FXCM UK, from $92 billion monthly in 2018 and $139 million per month in 2017.

With respect to Brexit, FXCM said that it is is “evaluating and putting in place strategic options” to minimize disruption to the company. The main strategic option being considered is the pursuit of establishing a new European Economic Area regulated entity that would be able to passport into the rest of Europe. A number of FXCM’s competitors are doing likewise, setting up licensed entities mostly in Cyprus.

Despite the loss, FXCM UK approved a dividend payment in the amount of $6.5 million to the company’s immediate parent, necessary to help pay the interest on the Jefferies loan.

FXCM offsets all of its clients’ FX trades and most of their CFD trades with liquidity providers, and with other FXCM and Jefferies Financial owned entities.

FXCM UK is the main operating subsidiary of FXCM, so we believe that these results are indicative of what occurred overall at FXCM globally in 2019. FXCM is effectively part of Jefferies Financial Group, which owns a direct 50% interest in the company but also is owed a further $71.6 million by FXCM (due next year), and is entitled to most if not all of FXCM’s free cash flow anyway. We believe that Jefferies will turn its “pieces” of FXCM into consolidated 100% ownership of the company at some point.

We should also point out that Jefferies noted in its latest financial results posted at the end of June that FXCM had a much better start to the year in 2020, as did many Retail FX brokers worldwide, although it didn’t provide numeric specifics behind its claim of “a record quarter for FXCM”.

Jefferies accounts for its ownership in FXCM using the equity method, basically making a discounted cash flow, accounting-based valuation of the outstanding loan to FXCM and potential future cash flows from FXCM, and periodically adjusting those values. As such, Jefferies doesn’t release much financial information about the actual operations of FXCM itself, so the FXCM UK annual regulatory filing is a key to getting a view of FXCM’s actual state of affairs.

Despite what we believe are misleading headlines on certain other blogs about potential losses Jefferies faces from its FXCM investment, Jefferies has done very well with its investment in FXCM. The company, then known as Leucadia, made a $300 million rescue loan in 2015 (actually $279 million, as $21 million was immediately returned to Jefferies as an advisory fee) to FXCM which allowed FXCM to avoid bankruptcy in the wake of the January 15, 2015 surprise spike in the value of the Swiss Franc. By the end of 2017 Jefferies had already received $331.6 million of combined principal and interest payments from that initial $279 million loan to FXCM – a return of its full initial loan principal plus a profit margin of 19%.

And, Jefferies is continued to be owed $71.6 million by FXCM as at November 30, 2019, with the loan paying interest of 20.5%. With FXCM’s revenue levels where they are it will be very hard for the company to repay the loan to Jefferies in time (or even the interest, which is more than $14 million annually!), leading (in part) to our assessment above that Jefferies will basically convert its “pieces” of FXCM into 100% outright ownership at some point.

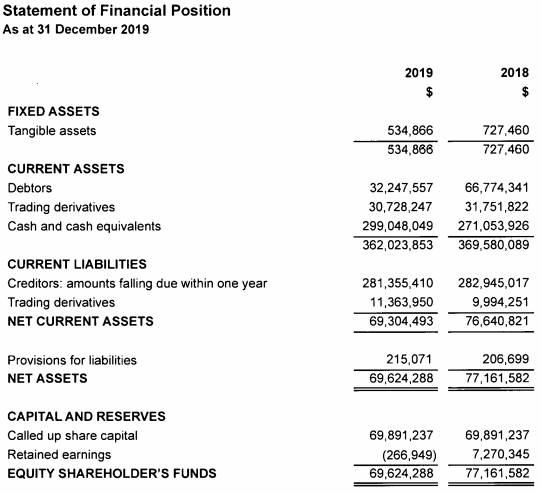

FXCM UK’s 2019 income statement and balance sheet follow:

July 15, 2020 @ 10:40 am

So what’s all this I read about Jefferies maximum loss from fxcm in the hundreds of millions of dollars?

July 15, 2020 @ 5:10 pm

Hi Kevin. That’s just an accounting thing, which we believe has confused some of the not-so-savvy writers at some FX blogs who just copy that phrase from Jefferies financials without understanding what it really means.

Jefferies does not consolidate FXCM into its financials, it accounts for FXCM using the “equity” method – basically carrying its FXCM investment on its books at the value determined by Jefferies’ accountants each quarter. So, at any point in time, Jefferies discloses deep in its financials that its total potential maximum loss from its FXCM investment is “X”, with “X” being whatever the current carrying cost is – just like any other asset Jefferies has on its books. If for some reason the value of FXCM drops to zero and Jefferies will get no more cash flow from FXCM, then indeed Jefferies will need to write its investment in FXCM down to zero, and take an accounting charge.

But that’s all it is (or might be), a simple accounting charge. As we note in the article Jefferies has already made a hefty profit on its investment in FXCM, and it basically owns the company and all future cash flows to come from FXCM.

July 16, 2020 @ 2:22 pm

HARD TO BELIEVE THE INDUSTRY LEADER HAS FALLEN SO FAR SO FAST. IT USED TO BE FXCM AND FOREX.COM AGAINST ALL COMERS NOW IT’S IG AND PLUS500 AND EXNESS AND ETORO. WHOSE GOING TO FALL NEXT?