Saxo Bank’s OpenAPI now able to support a host of new asset types

Multi-asset trading and investment specialist Saxo Bank has released a new version of its OpenAPI, with the solution now able to support a host of new asset types.

Please bear in mind that the asset types available for individual clients are restricted by country, region and segment specific configurations. Most of the new asset types listed are currently not generally available to the larger set of Saxo Bank clients.

A calling application should always check the list of “LegalAssetTypes”, provided on the portfolio/v1/accounts resource, to learn what is available to a particular client trading on a particular account.

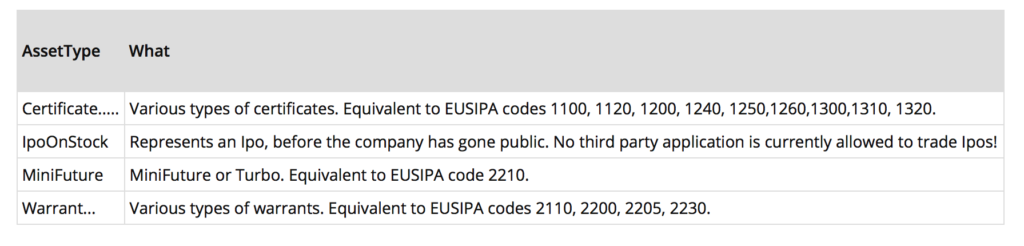

The new asset types fall in the following categories:

- Certificate: Various types of certificates. Equivalent to EUSIPA codes 1100, 1120, 1200, 1240, 1250,1260,1300,1310, 1320.

- IpoOnStock: Represents an Ipo, before the company has gone public. No third party application is currently allowed to trade Ipos!

- MiniFuture: MiniFuture or Turbo. Equivalent to EUSIPA code 2210.

- Warrant: Various types of warrants. Equivalent to EUSIPA codes 2110, 2200, 2205, 2230.

Saxo Bank regularly updates its OpenAPI, which is the backbone of trading platforms such as SaxoTraderGO. It offers:

- Access to all resources and functionality required to build a high-performance multi-asset trading platform.

- Better integration with Saxo Bank for partners and affiliates through a growing set of resources, such as Saxo’s Onboarding API.

The preceding release of the OpenAPI introduced a set of enhancements to various service groups, ranging from Asset Transfers to Trading. There are a raft of changes to Asset Transfers, as new resources have been added. For instance, the CashManagement resource allows a partner to look up the clients beneficiary instructions, and request a cash withdrawal on the clients behalf.