Deutsche Börse’s Forex segment 360T marks rise in revenues in Q4 2020

Deutsche Börse Group has published its financial report for the final quarter and full year of 2020.

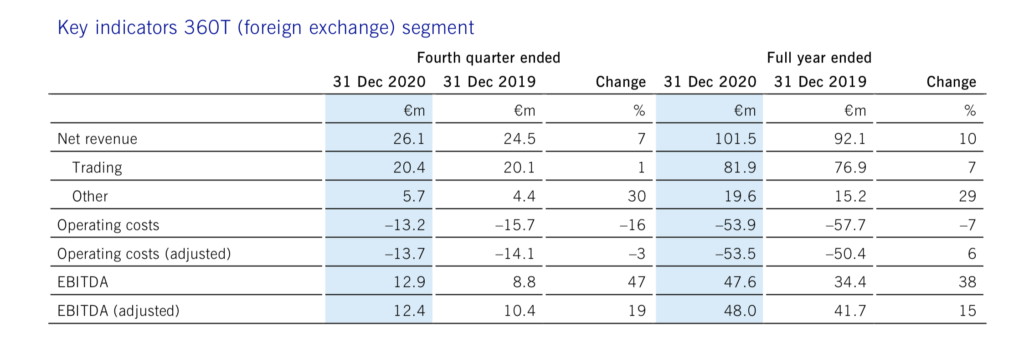

Deutsche Börse’s Forex segment 360T generated revenues of €26.1 million in the final quarter of 2020, up 7% from a year earlier. The result was also ahead of the revenues of €24.2 million registered in the third quarter of 2020.

For Deutsche Börse Group the financial year 2020 was influenced by the development of the COVID-19 pandemic, which in some cases had a significant impact on segment earnings. In an extraordinarily volatile market environment, the Group saw significant earnings increases in the first quarter of 2020, whereas markets became increasingly subdued over the remainder of the year and interest rates fell to new lows worldwide.

Secular net revenue growth across the Group amounted to 5% as planned, driven by product innovations, increasing market shares and a growing customer base. Cyclical effects contributed a total of 2% net revenue growth. Positive factors, such as the increase in trading volumes of equity index derivatives (Eurex segment) and equities (Xetra segment) were partly offset by a significant decline in net interest income from the banking business (Clearstream segment).

The Group also reported an increase of 2% in net revenue due to consolidation effects, primarily relating to the acquisitions of Axioma (Qontigo segment) and the UBS fund distribution platform Fondcenter AG (IFS segment). Total net revenue in the reporting period therefore rose to €3,213.8 million (2019: €2,936.0 million), an increase of 9%.

Deutsche Börse Group increased its earnings before interest, tax, depreciation and amortisation (EBITDA) to €1,877.3 million (2019: €1,678.3 million). Adjusted EBITDA rose to €2,024.7 million (2019: €1,813.2 million).

Overall, the net profit for the period attributable to Deutsche Börse Group shareholders was €1,087.9 million (2019: €1,003.9 million). Adjusted for exceptional items, it increased by 9% to €1,204.3 million (2019: €1,105.6 million) and thus exactly reached the company’s guidance of €1.20 billion.

For 2020, the Executive Board of Deutsche Börse AG proposes a dividend of €3.00 per share (2019: €2.90 per share), an increase of 3%. The dividend proposal is equivalent to a distribution ratio of 46% of the adjusted net profit and thus within the range set by Deutsche Börse Group’s dividend policy.

The dividend proposal requires formal approval by the Supervisory Board of Deutsche Börse AG, which has already expressed its support, and by Deutsche Börse AG’s shareholders at the Annual General Meeting on 19 May 2021.