Deutsche Börse’s 360T segment generates €26.4M in revenues in Q1 2021

Deutsche Börse Group has published its financial report for the first quarter of 2021, with the FX segment delivering revenues that are slightly lower than a year earlier.

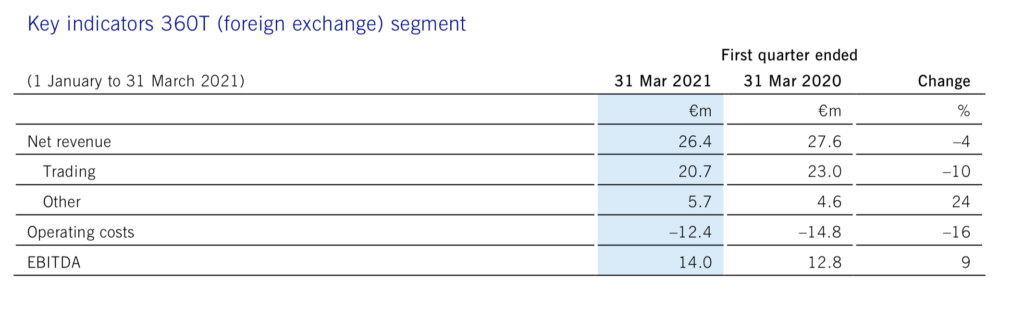

Deutsche Börse’s FX segment 360T posted net revenues of €26.4 million for the first three months of 2021, down 4% from the equivalent period a year earlier. The result for the first quarter of 2021 is, however, a bit better than the result reported for the final quarter of 2020.

Across all segments, Deutsche Börse Group reported net revenue of €855.1 million in the first quarter of 2021 (Q1/20: €914.8 million), which represents a decrease of 7% against the very strong first quarter of 2020. The substantial cyclical decline was partly offset by secular growth, primarily in the segments IFS (Investment Fund Services) and Clearstream (post-trading).

M&A activities also contributed to the Group’s growth in the form of the acquisitions of UBS Fondscenter AG (IFS segment) and ISS. In the reporting period, net revenue in the Clearstream segment benefited from an exceptional item related to a reimbursement of legal costs of around €17 million.

Adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) for Deutsche Börse Group fell by 12% to €521.2 million (Q1/20: €592.5 million). This includes the result from financial investments of €12.6 million (Q1/20: €–3.9 million). It benefited from a positive development of different shareholdings, including Tradegate AG Wertpapierhandelsbank where the very positive performance continued thanks to sustained high activity by private investors.

Net profit for the period attributable to Deutsche Börse AG shareholders was €317.3 million (Q1/20: €367.2 million), which was 14% below the result reported for the same period last year. Earnings per share came to €1.73 (Q1/20: €2.00) at an average of 183.5 million shares. Earnings per share before the effects of purchase price allocations (cash EPS) were €1.81 (Q1/20: €2.05).