Top FX and CFD trading industry news stories of 2024

2024 – what a year!

Volatility returned to the financial world, thanks (in part) to the return of Donald Trump to power in the US, alongside his love for crypto, and for shaking up international commerce and markets.

Healthy volatility led to record trading volumes from both retail and institutional traders, and to the expansion of operations across the globe of brokers, platform and liquidity providers, and virtually everyone involved in “the business”.

Our Top FX and CFD trading industry news stories of 2024 are a combination of the most-read articles of the year here on FNG, themes which emerged during the year, as well as stories which are bound to help shape the sector as we move forward into 2025.

What were the most-read stories this past year on FNG?

What were the key “deals of the year”?

Top management moves in the FX/CFDs sector?

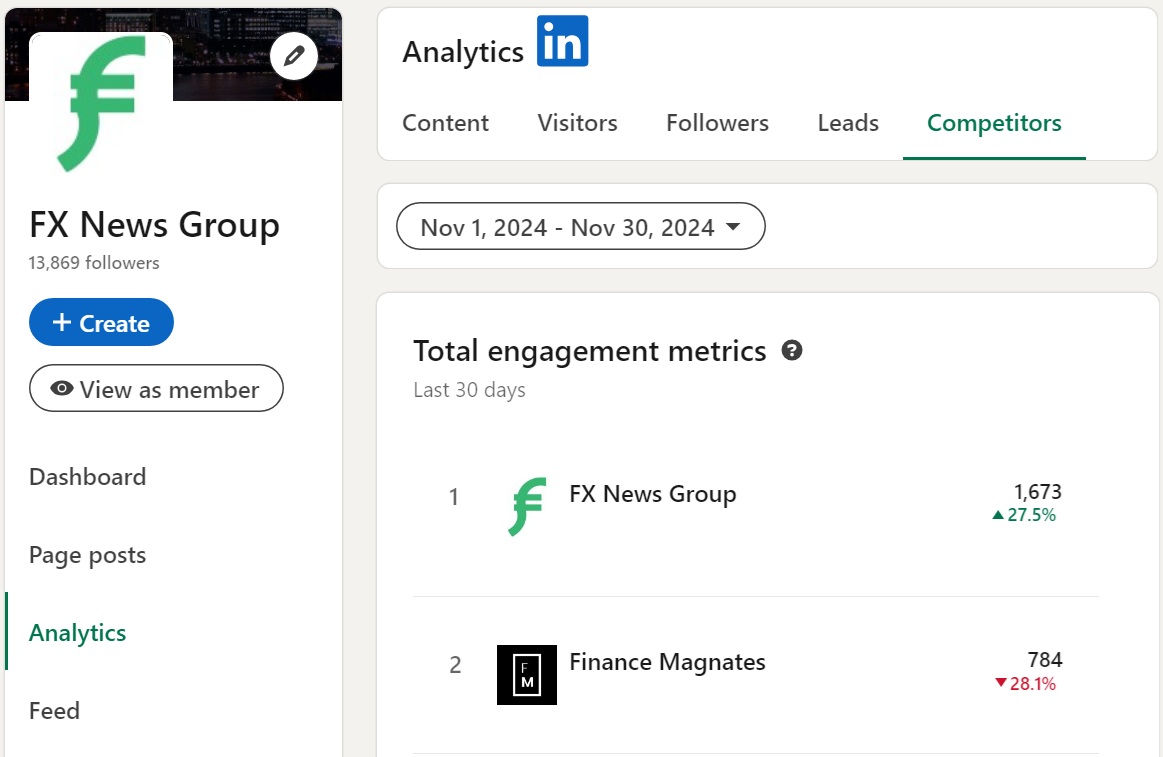

Before we begin, we here at FNG would like to take this opportunity to wish all our readers happy holidays, and a healthy and prosperous 2025. We appreciate you all making us the most-read (and, by our competitors, most copied!) FX/CFDs industry news site in 2024 as we broke virtually every news story in the sector that mattered – and we will continue to take that responsibility very seriously into 2025. FNG articles also dominated social media, getting several x the Engagement as compared to other “FX news” sites that just copy our headlines, publish promotional articles, and give out paid-for awards (see LinkedIn’s latest 30-day Competitor stats below).

Before we begin, we here at FNG would like to take this opportunity to wish all our readers happy holidays, and a healthy and prosperous 2025. We appreciate you all making us the most-read (and, by our competitors, most copied!) FX/CFDs industry news site in 2024 as we broke virtually every news story in the sector that mattered – and we will continue to take that responsibility very seriously into 2025. FNG articles also dominated social media, getting several x the Engagement as compared to other “FX news” sites that just copy our headlines, publish promotional articles, and give out paid-for awards (see LinkedIn’s latest 30-day Competitor stats below).

Hope to meet you all in person as well as online in the new year!

1. Emergence of the Prop Firms

Love ’em or hate ’em, retail proprietary trading “prop firms” emerged as a major force in 2024, accounting for an inexact but certainly important and significant new entry point for many new retail traders across the globe into the world of online financial trading.

Prop firms, which offer the promise of large funded trader accounts (in which the trader shares the profits with the prop firm) if the trader can pass a series of paid-for evaluations or competitions, became a dominant force in the industry and in the news for a variety of reasons.

Earlier in the year a ban by MetaQuotes from using its MT4 or MT5 trading platform at prop firms – which as a whole weren’t very careful with the clients they took (e.g. from the US) – led to a mad scramble among both prop firms and the Retail CFDs brokers who serve them to add alternative trading platforms. That in turn led to a banner year for tech and platform providers such as Spotware (cTrader), Match-Trade (Match-Trader), Leverate (SiRiX) and Devexperts (DXtrade).

A number of known retail brokers added their own prop operations, either under their own banner (e.g. Axi Select) or independent of the main brand.

A number of FX and CFD industry executives left their positions to set up their own shingle in the prop trading space.

While a study we posted recently showed that about 1 in 7 prop firms shut down during 2024, and despite warnings that regulators might soon take a closer look at the whole practice, it seems as though prop firms and prop trading have arrived big-time, and will continue to account for a healthy percentage of new recruits to online trading.

2. Failure of the neobrokers

The past few years have seen the rise of a new type of online broker on both sides of the Atlantic – the neobroker. Looking mainly for younger clients who do things on their mobile devices, a number of these brokers popped up in the EU looking to become “the Robinhood of Europe” offering a combination of leveraged trading (FX, CFDs) as well as “traditional” equity and index trading, and basic banking and savings services.

Sounded good on paper, but apparently harder to execute in the real world, as two of the better known names – BUX and FlowBank – basically have gone away. Amsterdam based BUX was effectively taken over by one of its initial backers, ABN Amro, following a failed UK launch, a failed CFDs brand launch (Stryk, out of Cyprus), and continuing losses. The brand now lives on as BUX by ABN Amro.

And in mid 2024, Geneva based FlowBank was forced into bankruptcy by Swiss regulator FINMA, which claimed that FlowBank had rising debt and insignificant capital levels to operate. The FlowBank situation also tripped up London based LCG, one of the oldest names in the FX and CFDs brokerage business, now stuck in the uncomfortable position of being a subsidiary of a now-bankrupt company. FlowBank’s liquidators, Walder Wyss, are actively looking for a buyer for LCG.

There still remain others, such as UK based Freetrade which seems to have made something of a comeback in 2024 after some heavy losses in 2023. UK online financial app and neobank Revolut is looking to enter the neobroker space, adding both stocks and CFDs trading in the UK and EU. And US based Robinhood had a good 2024, backed by rising crypto prices and – after previous failed attempts – expansion internationally to the UK and EU in 2024 with Asia in the plans for 2025. But the great neobroker takeover of online trading hasn’t yet materialized.

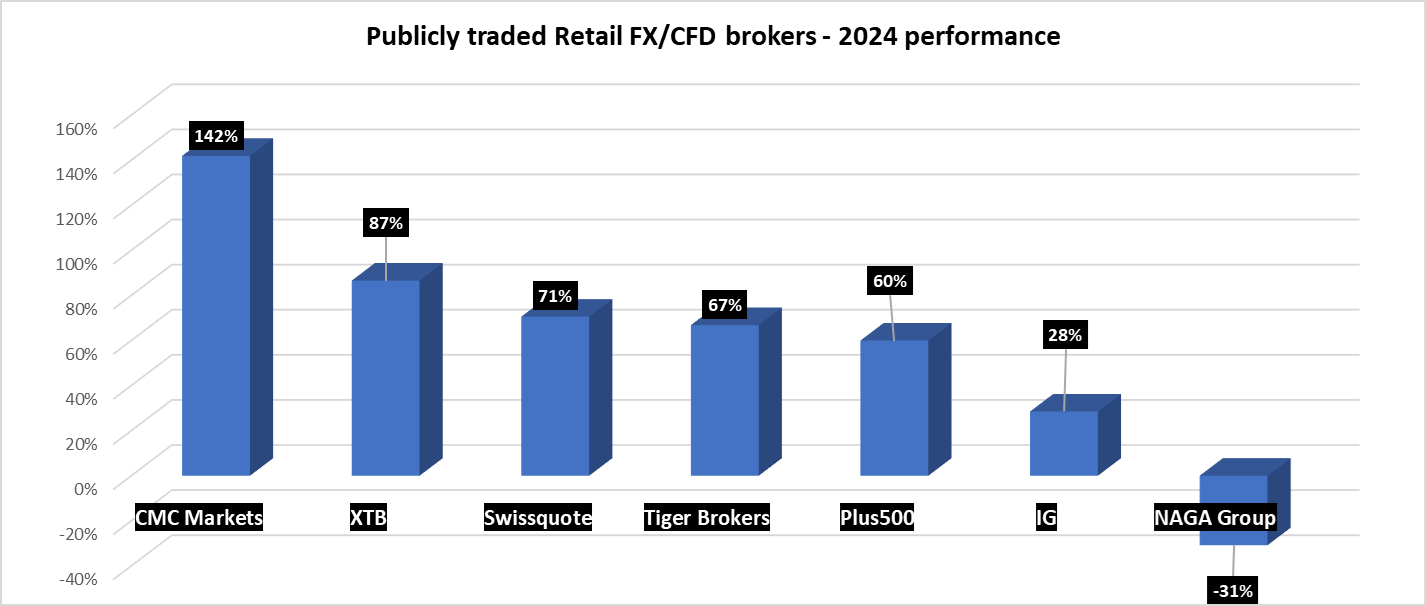

3. Publicly traded brokers soar

With the backdrop of a very good year for the equity markets overall – S&P500 up 26% in 2024 year-to-date, FTSE up 6%, DAX up 19%… – as well as a year-long bull run in crypto, the shares of publicly traded online Retail FX and CFDs brokers also had a very good year in 2024.

Overall, shares of the online broker universe tracked by FNG traded up by an average of more than 60% in 2024, one of the best-ever years for the sector.

Led by a more-than doubling at CMC Markets (although its shares were actually down in the second half of the year), and robust results leading to all-time share price highs at Poland-based XTB and Switzerland’s Swissquote, those who invested in Retail FX and CFDs brokers just by holding their shares in 2024 did very, very well.

| Retail FX broker shares 2024 YTD | ||||

| Share Price as of… | Mkt Cap | |||

| 31-Dec-23 | 27-Dec-24 | % change | (USD $M) | |

| CMC Markets | 105 | 254 | 142% | 894 |

| XTB | 37.82 | 70.56 | 87% | 2026 |

| Swissquote | 204.6 | 349 | 71% | 5819 |

| Tiger Brokers | 4.13 | 6.89 | 67% | 1270 |

| Plus500 | 1669 | 2670 | 60% | 2452 |

| IG | 769 | 988 | 28% | 4400 |

| NAGA Group | 1.07 | 0.74 | -31% | 175 |

| Average return | 60.5% | |||

| Median return | 66.8% | |||

What does this mean for the industry?

Well…

4. Return of the CFDs broker IPO (and exit)

It has been a while since a Retail FX and CFDs broker went public, with the last successful IPO being that of XTB in 2016, more than eight years ago.

Several attempts by brokers to go public via the SPAC route – merging with a special purpose acquisition company (or SPAC) which is already publicly traded – fell flat over the past couple of years, with each of ThinkMarkets, Saxo Bank, and most notably eToro seeing their IPO-via-SPAC plans fail.

However with the overall stock markets in a good mood, existing publicly traded brokers doing very well (as noted above), and a general pro-deal environment now with us, it looks like the IPO might be making a comeback.

We have recently reported that eToro is back at it and seriously looking again at walking down the aisle with public market investors, with the company hiring Goldman Sachs late this year to begin the IPO process, most likely on a US market (NYSE or NASDAQ).

Saxo Bank has also engaged Goldman Sachs, but it looks like that is more for an attempted sale of the company, as its major outside shareholders (China’s Geely Group and Finland’s Mandatum) seek to monetize their respective holdings in Saxo.

The parent company of Australia based broker ACY Securities, ACYLogix, is also targeting an IPO, but that might occur a little further down the road.

Other exits (or ownership changes) among leading brokers we saw in 2024 included INFINOX, NAGA Group, and HYCM.

5. Management moves galore – including CEOs

One of the constants in the FX and CFDs business is change. And that theme played true when looking at the numerous senior management moves that we witnessed over the past 12 months in the industry, including quite a few at the top rung of the ladder, in the CEO’s office.

Most notable among the C-Suite changes was Estonia based online broker Admirals, which saw the departure of longtime CEO Sergei Bogatenkov and virtually his entire management board, after Admirals saw its Revenues collapse 41% in 2023. Company founder Alexander Tsikhilov has taken over the CEO role for the time being at Admirals.

Also noteworthy is the CEO change at NAGA Group, with Capex.com CEO and controlling shareholder Octavian Patrascu taking the reins at NAGA ahead of Capex.com’s takeover of NAGA earlier this year.

Other notable CEO-level moves reported at FNG over the past 12 months include:

- INFINOX saw the departure of longtime CEO Robert Berkeley, replaced by Jay Mawji.

- TopFX hires Victor Zachariades as CEO, replacing Alex Katsaros.

- Capital.com CEO Kypros Zoumidou steps down, replaced by a series of regional CEOs at the company.

- Glenn Stevens leaves Forex.com, with Philip Smith becoming overall StoneX CEO.

- Ben Hurley replaces Michael Babushkin as CEO of Devexperts.

- Nicos Vassiliou hired as CEO of CySEC licensed CFDs broker Colmex Pro.

- Breon Corcoran assumes role of IG Group CEO.

- Tickmill alum Simon Andras becomes CEO of new offshore CFDs broker ConnextFX.

- Capital Index CEO Trevor Barwell resigns.

- Skilling installs George Kyriakoudes as CEO, after Michael Kamerman resigned.

- Online Halal investing platform Wahed names OANDA alum Mohsin Siddiqui as CEO.

- Viktor Nebehaj replaces Adam Dodds as CEO of Freetrade.