IG Group marks 65% Y/Y jump in revenues in Q3 FY21

Electronic trading major IG Group Holdings plc (LON:IGG) today provided an update on its performance for the quarter to end-February 2021 (Q3 FY21), with the period marked by high client trading activity.

Following a set of solid results for the first half of the fiscal year to May 2021, IG saw another consecutive, exceptional quarter for revenues driven by continued high levels of client activity, with the Significant Opportunities revenue target now anticipated to be substantially achieved in FY21, a year ahead of plan.

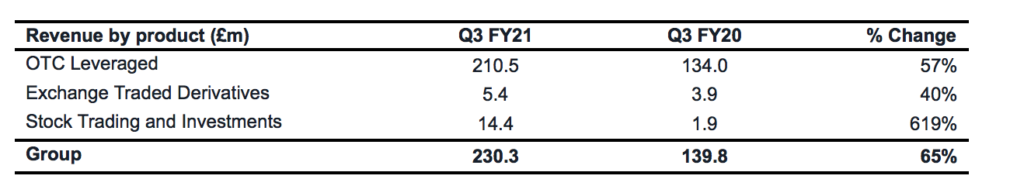

Revenues for the third quarter amounted to £230.3 million, 65% higher than the same period in the prior year and up 11% on Q2 FY21. Performance was driven by a combination of sustained elevated levels of trading from IG’s existing clients and continued high levels of client acquisition with a record 230,100 clients active in the quarter, representing growth of 60% year over year (Q3 FY20: 143,800) and 11% on Q2 FY21.

The level of revenue per client for the Group’s OTC Leveraged clients was maintained at similar levels to those reported in Q1 and Q2 FY21 and 9% higher than the prior year period.

- Q3 FY21 revenue in the Core Markets was £192.7 million, up 67% year over year (Q3 FY20: £115.7 million) with active clients reaching 191,700. Within IG’s non-leveraged offering, the broker saw a period of exceptional demand which drove significant increases in revenue, revenue per client, and client acquisition in the period.

- Q3 FY21 revenue in the Significant Opportunities portfolio was £37.6 million, up 55% on the prior year period (Q3 FY20: £24.2 million). This was largely driven by a 50% increase in the number of active clients to 40,100 (Q3 FY20: 26,700).

IG only briefly mentioned the recent spike in market volatility. The level of client acquisition in Q3 was similar to the elevated levels seen in the prior two quarters of FY21 with the exception of a short period in late January / early February when the Group saw an unprecedented spike in new client demand, largely in response to heightened news flow relating to certain listed US stocks.

Importantly, IG provided an update on its plans to acquire tastytrade.

IG said the tastyworks brokerage business accelerated its rate of active account growth in 2021 and reported a 100% increase in the number of active trading accounts during the month of February 2021 versus the prior year period. The strong performance in brokerage is mirrored in the tastytrade education and content business, with registrants growing by over 100,000 in the two months to the end of February to nearly 1 million.

With some regulatory approvals now obtained and others pending but on track, the acquisition is anticipated to close in the first quarter of FY22, IG said.

In terms of outlook, IG said it is in a strong position to deliver on its growth strategy and will continue to optimise its resources to deliver longer term attractive growth. If IG sees normalisation in financial market volatility, or a stabilisation in the macro environment, it would anticipate some reduction in the level of client acquisition and activity, although underpinned by the larger high-quality client base.