FXCM AU offers non-Australian residents to transfer to Bermuda brokerage

FXCM Australia Pty. Limited (“FXCM AU” or “FXCM Australia”) has provided an update to its clients regarding ASIC’s Product Intervention.

Due to the changes in Australian CFD regulations, which came into effect on March 29, 2021, FXCM AU says it has received many questions from clients who wish to regain access to their previous leverage levels.

The company offers a transfer to its offshore entity to non-Australia residents. Such clients have the option to keep their leverage settings by transferring their account(s) to FXCM Markets Limited (“FXCM Markets”).

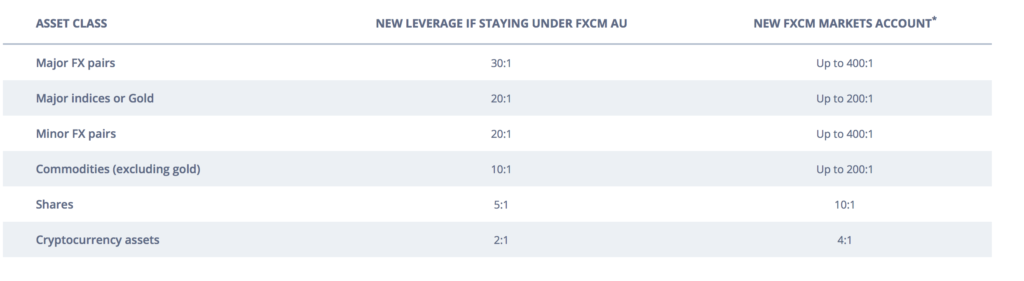

Those clients who transfer to FXCM Markets will see their leverage levels increase as referenced below.

The broker warns that higher leverage can increase the magnitude of losses. If traders decide to stay with FXCM Australia Pty Limited (“FXCM AU”), the recent reduction in leverage levels resulting from ASIC’s Product Intervention measures will remain in effect.

After those willing to transfer complete and submit the required form, the positions and money in their current account(s) will automatically transfer over to FXCM Markets on Friday, 23rd April 2021, after 5pm EST.

FXCM Markets is incorporated in Bermuda as an operating subsidiary within the FXCM group of companies (collectively, the “FXCM Group” or “FXCM”). FXCM Markets is not required to hold any financial services license or authorization in Bermuda to offer its products and services and is a non-regulated entity.

While traders that transfer to the Bermuda entity will retain the ability to trade with their current leverage, they will no longer be subject to the Australian Securities and Investment Commission’s (ASIC) oversight and will lose a number of the regulatory protections otherwise afforded to clients under FXCM AU, such as:

- Client money rules and protection provided in accordance with the Australian’s Corporations Act 2001 (Cth);

- The right to make complaints to the Australian Financial Complaints Authority (“AFCA”) and be compensated, where appropriate;

- The provision of disclosure documents that contain material information to clients (such as disclosures about products, trading risks and features, cost and charges, as described in FXCM AU’s Product Disclosure Statement and Financial Services Guide);

- Additional protections under ASIC Corporations (Product Intervention Order – Contracts for Difference) Instrument 2020/986 including negative balance protection;

- Assessment of appropriateness.