UK fin watchdog misses target for answering firms’ phone calls

The UK Financial Conduct Authority (FCA) has always been ambitious when setting itself goals and outlining its plans. This year, it has spectacularly failed to perform a basic task – picking up the phone.

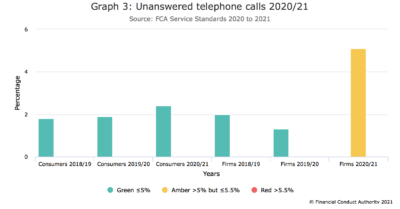

According to the latest data for 2020/21, the FCA has missed its own target for answering firms’ phone calls.

The regulator aims for no more than 5% of unanswered telephone calls for both firms and consumers. This is a voluntary target. The FCA has achieved this target this year for consumers but has missed this target for firms.

Contact volumes for the firm helpline over the course of the year finished 10% higher than the previous year with most of this increase received from November 2020 onwards. There are several reasons for this increase including:

- a substantial system change as firms began the migration from the Gabriel reporting system to the new RegData system;

- a regulatory change for many firms with the registration of Directory Persons;

- 23,000 regulated firms were asked to complete the FCA’s Financial Resilience survey.

Due to the relatively short-term nature of these contact peaks, the FCA says it was unable to resource to these levels and the voluntary service standard was missed.

Other areas where the FCA still needs to improve are:

- The response rate for substantive replies to MP letters – the FCA’s target is to respond to 80% of these letters within 15 working days and 100% within 20 working days. During 2019/20, its response rate within the 15-day timescale was 49.7%, dropping to 28.4% in 2020/21, this was due to the increase in the number of letters received.

- The response rate when completing an investigation into a complaint – the time taken to respond to complaints has reduced further this year due to an increase in the volume of incoming complaints.

- Processing an application for ‘approved person’ status – while the volume of CF and SIF applications has reduced following the start of the Senior Managers & Certification Regime (SM&CR) for solo-regulated firms in late 2019, prior to SM&CR the FCA received a very large number of solo-regulated firm applications for Senior Manager Functions (SMFs) under SMCR. This was well above the expected level of conversion activity and as a result, the proportion of cases processed within deadline fell from 83.9% in 2019 to 56.6% this year, below its voluntary target of 85%.

- Processing complete notifications for appointed representative status – the FCA saw another decline within target this year, dropping from 84.2% in 2020 to 48.1%. This was affected by resource stretch, driven by the significant number of solo regulated firm-related applications it received in December 2019, due to the introduction of the SM&CR for such firms.