FCA-regulated firms receive 2.19M complaints in H2 2020

The UK Financial Conduct Authority (FCA) today posted the latest data about complaints received by the firms it regulates.

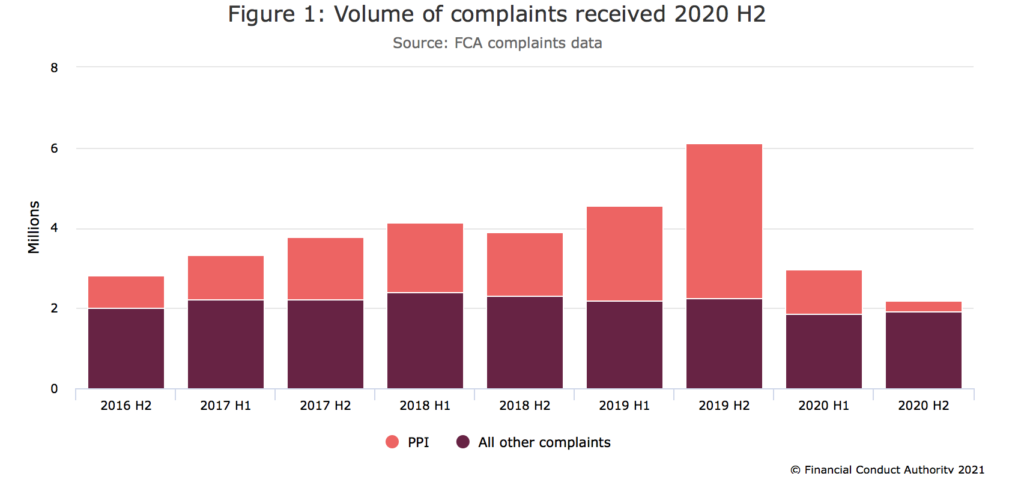

In 2020 H2 firms received 2.19 million complaints, 26% lower than in 2020 H1 (2.96m complaints). These are the lowest levels recorded since 2016 H2.

The insurance and pure protection product group saw the largest decrease in complaints received by firms, from 1.80m complaints in 2020 H1 to 1.02m complaints in 2020 H2. Within this product group, the largest decrease was for Payment Protection Insurance (PPI), with a 77% decrease from 1.09m complaints received in 2020 H1 to 256,000 complaints in 2020 H2.

Excluding PPI, the volume of complaints received by firms increased by 3.3% in 2020 H2 when compared with 2020 H1, from 1.87m to 1.93m.

The most complained about products in 2020 H2 were current accounts (23% of all complaints), PPI (12%), credit cards (11%), other general insurance products (11%) and motor & transport insurance (9%).

The total redress paid for all complaints, including PPI, decreased by 35% from £2,230m in 2020 H1 to £1,439m in 2020 H2.

Let’s note that investment firms upheld 27,857 complaints in the second half of 2020, down from 29,049 in the first half of 2020.

The redress paid for complaints upheld by investment firms in the second half of 2020 amounted to GBP28.7 million, up from GBP 28.4 million paid in redress in the first half of 2020.