FCA registers slight drop in complaints received by fin services firms in H2 2022

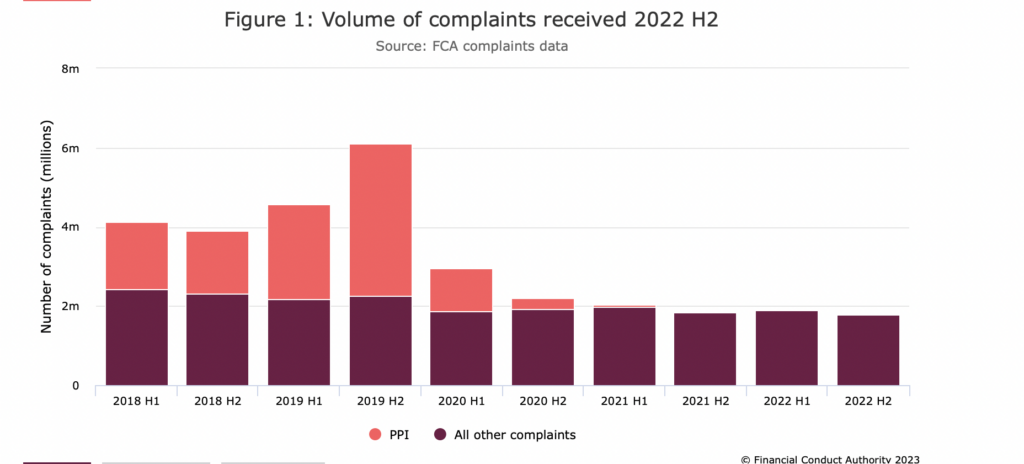

The UK Financial Conduct Authority (FCA) today posted the latest data about complaints received by financial services firms. The data represents an overview of financial services firms’ complaints reported to the FCA during 2022 H2 (1 July to 31 December 2022).

In the second half of 2022, financial services firms received 1.79 million complaints, a decrease of 6% from the first half of 2022 (1.91m).

The product groups that experienced a decrease in their complaint numbers were banking and credit cards (5%), insurance and pure protection (10%), and investments (10%).

The home finance product group saw the biggest increase (14%) in complaints received by firms, from 88,514 in 2022 H1 to 101,331 in 2022 H2.

Decumulation and pensions also saw a 4% increase in complaints from 70,200 in 2022 H1 to 73,069 in 2022 H2.

Since 2016 H2, current accounts have remained the most complained about products. However, the number of complaints decreased, from 528,850 in 2022 H1 to 500,371 in 2022 H2 (5%).

Noticeable increases can be seen in the following products: savings (including ISAs) from 51,415 in 2022 H1 to 69,256 in 2022 H2 (35%), travel from 22,261 in 2022 H1 to 31,987 in 2022 H2 (44%), and assistance from 26,428 in 2022 H1 to 29,091 in 2022 H2 (10%).

The percentage of complaints upheld decreased from 61% in 2022 H1 to 60% in 2022 H2. Before 2022 H2, the percentage of upheld complaints had been steadily rising since 2019 H2.

In 2022 the total amount of redress fell 25%, from £304m in 2022 H1 to £228m in 2022 H2. This is a smaller decrease compared to the 2021 figures in which the total amount of redress fell 48%, from £568m in 2021 H1 to £294m in 2022 H2.

The decrease in the total amount of redress for 2022 can be largely attributed to insurance and pure protection that decreased by 55% from £91m in 2022 H1 to £41m in 2022 H2.