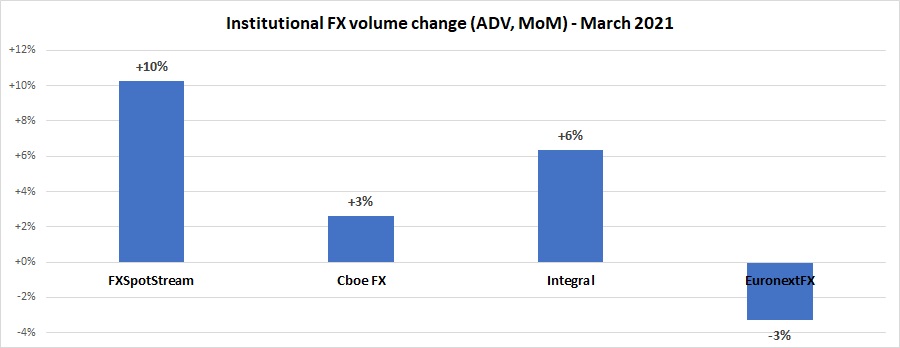

Institutional FX volumes edge up by 4% in March 2021

Trading volumes at leading institutional FX venues were up in March 2021 for the third consecutive month, marking a very strong start to the year for the sector.

Overall, daily average trading volumes increased by 4.0% MoM at leading eFX platforms, with only EuronextFX showing a slight (3.3%) decline in activity.

Cboe FX (formerly HotspotFX)

- March 2021 average daily volumes were $38.3 billion, +3% MoM

EuronextFX (formerly FastMatch)

- March 2021 ADV $21.17 billion, -3.3% below February’s ADV $21.89 billion.

FXSpotStream

- March ’21 saw FXSpotStream cross the USD1trillion mark in terms of volume supported for only the second time in company history.

- FXSpotStream’s ADV MoM (Mar ‘21 vs Feb ‘21) increased 10.24% to USD54.674billion.

- FXSpotStream’s Overall Volume MoM (Mar ‘21 vs Feb ‘21) increased 26.78% to USD1.258trillion.

- FXSpotStream’s ADV YoY (Mar ‘21 vs Mar ‘20) decreased 12.35%.

- FXSpotStream’s ADV (Q1 ‘21 vs Q1 ‘20) increased 4.38% to USD51.272billion.

- FXSpotStream’s Overall Volume (Q1 ‘21 vs Q1 ‘20) increased 2.75% to USD3.230trillion.

Integral

- Average daily volumes (ADV) across Integral platforms totaled $53.6 billion in March, up 6.3% from February’s $50.4 billion.

- March 2021 represented the second highest monthly volumes on record for Integral, second only to March 2020 which saw considerable volumes due to the pandemic-induced volatility.

- The rise for March 2021 follows a recent trend of upward growth in volumes for Integral and is attributed to the increasing activity on TrueFX over the last 6 months.