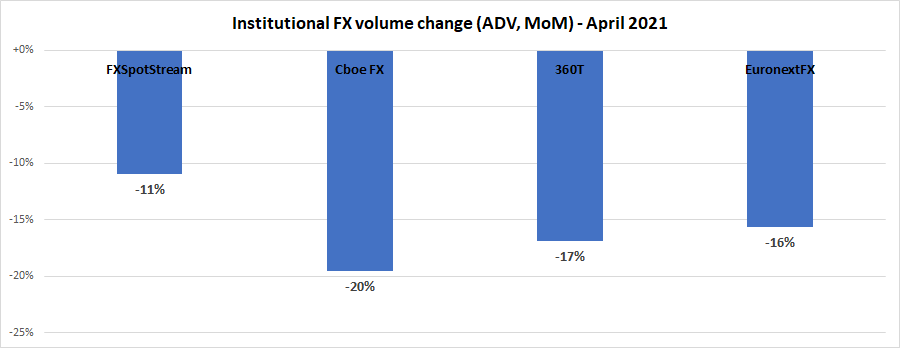

Institutional FX trading volumes drop 16%+ in April 2021

After beginning the year with a number of consecutive strong months of trading, institutional FX activity slowed somewhat across all eFX venues in April – despite continued good currency volatility.

On average, each of Cboe FX, EuronextFX, FXSpotStream and Deutsche Borse’s 360T saw a 16% MoM decline in volumes from March – the largest of which being Cboe FX’s 20% decline.

The decline didn’t seem to stem from a lack of currency volatility, which was plentiful during April. However the Easter long weekend at the beginning of the month (and the Orthodox Easter at end-of-month) seem to have slowed things down somewhat.

Cboe FX (formerly HotspotFX)

- April 2021 average daily volumes were $30.79 billion, -20% MoM

EuronextFX (formerly FastMatch)

- April 2021 ADV $17.86 billion, -16% below March’s ADV $21.17 billion.

FXSpotStream

- ADV of USD48.705billion, an increase of 43.35% YoY vs April ‘20. April saw FXSpotStream’s Overall Volume surpass USD1trillion for the third time in the company’s history.

- FXSpotStream’s Overall Volume YoY (Apr ‘21 vs Apr ‘20) increased 43.35% to USD1.071trillion.

- FXSpotStream’s ADV YoY (Apr ‘21 vs Apr ‘20) increased 43.35% to USD48.705billion.

- FXSpotStream’s ADV MoM (Apr ‘21 vs Mar ‘21) decreased 10.92% to USD48.7054billion following March 2021, which registered as the second highest ADV on record.

- FXSpotStream’s ADV YTD (Jan-Apr ‘21 vs Jan-Apr ‘20) increased 11.85% to USD50.608billion when compared to the same period last year.

360T

- Average daily volumes (ADV) at 360T came in at $21.02 billion in April, down 17% from March’s $25.29 billion.