BGC Partners registers drop in FX revenues in Q3 2020

Global brokerage and financial technology company BGC Partners, Inc. (NASDAQ:BGCP) today released its financial results for the third quarter of 2020.

- Net income amounted to $29.6 million in the quarter to end-September 2020, compared with a net loss of $3.5 million a year earlier.

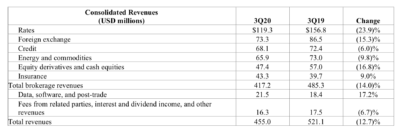

- Revenues for the third quarter of 2020 were $455 million, down from $521.1 million registered in the equivalent period a year earlier.

BGC’s brokerage revenues are driven mainly by secondary trading volumes in the markets in which it transacts. Fenics net revenues increased 19% in the third quarter of 2020 driven by double-digit growth in electronic brokerage and data, software, and post-trade.

BGC’s insurance brokerage business benefitted from favorable pricing trends and improved productivity from previously hired brokers and salespeople. BGC continued its focus on optimizing its front office headcount and reducing expenses in less profitable businesses, which lowered revenues in the short-term, but is expected to increase profitability going forward.

In addition, the company’s rates, FX, credit, and equities businesses were adversely impacted by lower year-on-year secondary trading volumes in certain markets during the quarter, while historically low prices across energy and commodities reduced demand for underlying product hedges.

Revenues from FX amounted to $73.3 million in the third quarter of 2020, down 15.3% from the result of $86.5 million recorded in the corresponding period a year earlier. Revenues from energy and commodities fell 9.8% in annual terms, whereas rates revenues dropped 23.9%.

In terms of more recent performance, BGC notes that its revenues were 4.4% lower year-on-year for the first 17 trading days of the fourth quarter of 2020. The company is beginning to see evidence of a return to growth. For example, in the first 17 trading days of the fourth quarter of 2020, Asia Pacific revenues increased approximately 5%, and continental Europe was up over 10%, representing BGC’s first regional increases in revenues since the start of the pandemic.

Regarding its corporate structure, BGC Partners says that it continues to explore a possible conversion into a simpler corporate structure. An important factor will be any significant change in taxation policy in any of the major jurisdictions in which the company operates and its stakeholders reside, particularly the United States whose tax policies are likely to be affected by the outcome of the elections on November 3, 2020.

This quarter, the company will continue to work with regulators, lenders, and rating agencies regarding any possible conversion, and BGC’s board committees will review potential transaction arrangements.