Standard Chartered reports slight increase in FX income in Q3 2020

Standard Chartered PLC (LON:STAN) today reported its financial results for the third quarter of 2020, with Financial Markets delivering solid results.

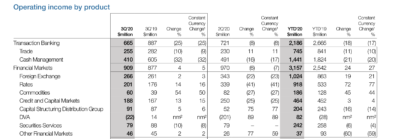

Financial Markets income grew 4% from a year earlier, reaching $909 million. The rise was 8% if excluding DVA. The increase was registered in the face of significantly lower levels of market volatility than in the first half of this year. It was supported by the impact of improvements made to the business model in recent years as well as increased hedging and investment activity by clients.

There was double-digit growth in Rates, Commodities, Credit and Capital Markets while Foreign Exchange income was up slightly. Forex operating income amounted to $266 million in the third quarter of 2020, up from $261 million a year earlier.

Income from Securities Services declined 10% due to lower margins partly offset by higher volumes.

Across all segments, operating income was $3.5 billion, marking a drop of 12% from a year earlier and a drop of 10% on a constant currency basis and excluding a $36 million negative movement in the debit valuation adjustment (DVA). The impact of lower interest rates was partially offset by strong performances in Wealth Management and Financial Markets.

Net interest income decreased 16% with increased volumes more than offset by a 24% (38 basis points) decline in net interest margin

Underlying profit before tax was $745 million, down 40% from a year earlier.

In terms of dividend, Standard Chartered hinted at possible resumption. Andy Halford, Group Chief Financial Officer, said:

“On 25 February 2021 we will release our full-year 2020 results and will provide an update on the progress we are making on our strategic priorities in the context of the prevailing macroeconomic outlook. Given our strong capital position the Board will consider at that time resuming shareholder returns, subject to consultation with our regulators”.

Regarding outlook, Standard Chartered expects similar fourth quarter seasonality to last year, and anticipates client demand to increase over the course of 2021 as more of the markets in which the Group operates start to come out of recession. “The impact of the significant reduction in interest rates that occurred earlier this year should be fully reflected over the next two quarters with the net interest margin stabilising slightly below the current level in that timeframe”, Standard Chartered forecasts.

Standard Chartered says it will continue to optimise the drivers of its net interest income and is increasingly focusing on generating more fee-based income, particularly from its Financial Markets and Wealth Management businesses that have good momentum.