Deutsche Bank marks 47% jump in Fixed Income & Currency sales & trading revenues in Q3 2020

Deutsche Bank AG (ETR:DBK) today released its financial report for the third quarter of 2020, with solid results underpinned by robust performance of the Core Bank segment.

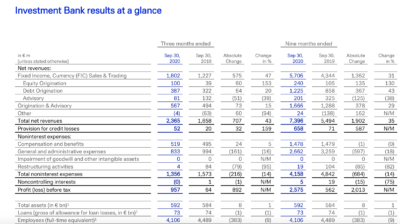

The Investment Bank segment saw Q3 2020 net revenues of 2.4 billion euros, a 43% increase from the prior year period. Growth in net revenues was driven by ongoing client re-engagement around Deutsche Bank’s refocused strategy, supported by strong market conditions and strong client flows.

Fixed Income & Currency (FIC) Sales & Trading net revenues amounted to 1.8 billion euros in the third quarter of 2020, up 47% from the equivalent period a year earlier. Net revenues in Rates more than doubled versus the prior year quarter while Credit Trading net revenues were significantly higher, on increased client activity. FX net revenues were also significantly higher and benefited from higher market volatility.

Emerging Markets also increased versus a weak prior year quarter, driven by strength in CEEMEA and Latin America. Financing net revenues were broadly flat excluding the impact of FX translation and were supported by higher primary market issuance activity in asset-backed securities.

Across all segments, profit in the third quarter of 2020 was 309 million euros, compared to a net loss of 832 million euros in the third quarter of 2019. Profit before tax was 482 million euros, compared to a loss before tax of 687 million euros in the prior year quarter.

Net revenues grew by 13% year-on-year, accompanied by a 10% reduction in noninterest expenses versus the prior year. Adjusted profit before tax, which excludes specific revenue items, transformation charges and restructuring and severance, was 826 million euros compared to a loss of 84 million euros in the prior year quarter.

These results were driven by profit growth in the Core Bank, together with lower losses in the Capital Release Unit. Core Bank profit before tax rose nearly three-fold year-on-year to 909 million euros and adjusted profit before tax1 grew by 87% to 1.2 billion euros. Core Bank net revenues grew 9% with noninterest expenses down 4% year-on-year.