NAGA Group files application for listing on OTCQX Venture Market

Fintech company NAGA Group AG (ETR:N4G) today announces that it has filed an application with OTC Markets Group for the company’s shares to be cross traded publicly on the OTCQX Venture Market.

The listing is set to make NAGA shares more widely available to North American investors. Trading on the US OTCQX market would have no impact on existing NAGA’s ordinary shares and no new ordinary shares will be issued as part of the cross-trade. NAGA will continue to rely on the announcements and disclosures it makes to Scale and will have no SEC reporting requirements.

Should the application be successful, the cross-trading facility will be provided through OTC Markets Group Inc., located in New York, USA. OTC Markets operates the world’s largest electronic interdealer quotation system for US broker dealers and offers multiple media channels to increase the visibility of OTC-traded companies.

NAGA CEO Benjamin Bilski comments:

“We would like to make NAGA Group AG available to US markets in order to gain access to a broader investor base and enhance our visibility in North America. Cross trading on OTC Markets represents an important development for the company.”

Furthermore, NAGA reports that the convertible bonds with a nominal value of EUR 8 million have been placed in full.

Also today, NAGA reported its preliminary unaudited results of the first quarter 2021.

Unaudited group sales jumped by 69% to USD 13.7 million (Q1 2020: USD 8.1 million), whilst the number of real-money transactions jumped by 141% to 2.9 million (Q1 2020: 1.2 million). Traded volume crossed USD 70 billion, an increase of 155% (Q1 2020: USD 27 billion).

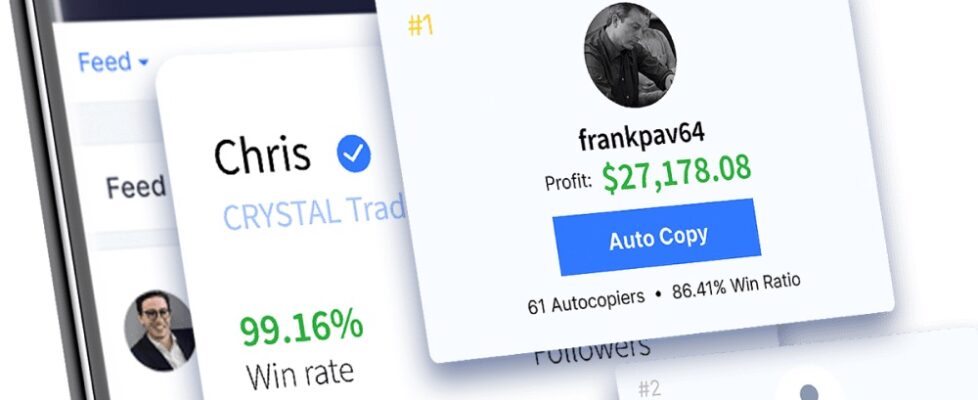

Signups inreased by 480% to 93,000 in Q1 2021 compared to 16,000 account signups in Q1 2020. More than 1.4 million trades were copied trades on the NAGA platform, which is an increase of more than 475% compared to 0.27 million copied trades in Q1 2020.

“We are on track to hit our annual targets. We will continue to scale marketing and further optimize our acquisition funnels. Comparing growth and further potential to our competition, but also private FinTech companies, we are very confident about our future upside. Given the shift of user demands and the positive feedback we are receiving about our unique platform, we will announce major exciting product updates in the upcoming quarters to strengthen our position as social neo-broker and investing platform”, adds Bilski.