Exclusive: FX broker NAGA Group raises €8M from PIPE investor Yorkville

FNG Exclusive… FNG has learned that Hamburg, Germany based Retail FX and CFD broker NAGA Group AG has inked an agreement with specialist investor Yorkville Advisors, which could see NAGA raise up to €25 million (USD $30 million) in capital over the next three years.

Initially, NAGA plans to draw down on an initial €8 million (USD $9.5 million) investment.

The investment made by the Mountainside, New Jersey based Yorkville into NAGA will be made via convertible bonds. The bonds will be purchased at a cost of 95% of face value by Yorkville. The conversion price per share is calculated as 95% of the market price of NAGA Group (FRA:N4G) on the five consecutive trading days before submitting a notice of exercise. Effectively, Yorkville is buying NAGA shares but with the downside protection of a bond, in case NAGA’s share price declines after the investment is made.

Yorkville Advisors specializes in PIPEs – private investment in public equities. The company typically makes investments into growth oriented, publicly traded small and mid cap companies via convertible debt or other structured investments, seeking to exit in the medium to long term.

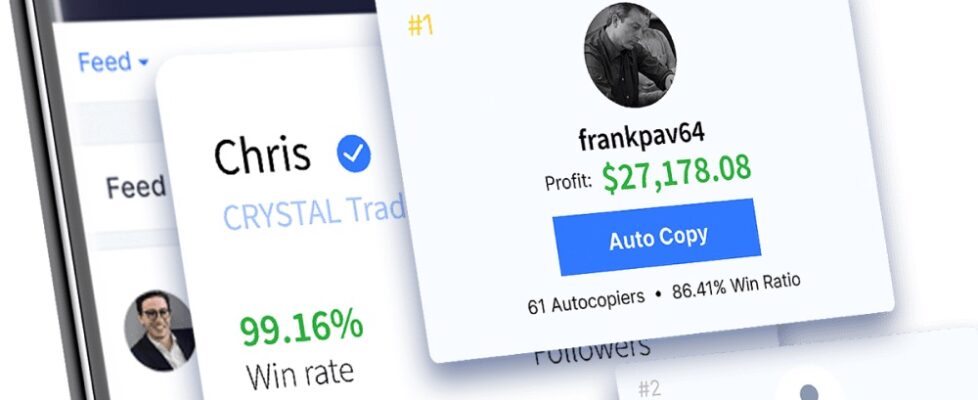

Social trading focused NAGA Group, which operates the NAGA.com website, rocketed to prominence in 2020 as the retail trading boom took hold, and was the best performing stock among the publicly traded Retail FX brokers tracked by FNG during the year. After seeing a six-fold rise in its share price in 2020, NAGA shares are up another 50%+ so far in 2021. NAGA’s current market capitalization is €282 million. The company reported record monthly client trading volumes of $22.0 billion for January 2021, and $23.8 billion in February 2021.

NAGA CEO Benjamin Bilski commented on the deal:

NAGA CEO Benjamin Bilski commented on the deal:

“We are excited about the deal with Yorkville and are setting the course for NAGA to scale even faster. The financing gives us the power and the flexibility to allow the company to be taken to the next level. NAGA is a growth case in a very large and rapidly growing market. This decade will be definitely the breakthrough period for FinTechs.”

“The user growth, and particularly the activity and engagement ratios make us feel very confident. Evidently the concept of social media combined with trading at NAGA works very well. There is a clear shift in user behavior towards platforms like NAGA which combines stocks, cryptocurrencies and community, and it will be our core advantage over competition, especially in the area of customer-acquisition. As communicated before, we have developed a unique growth formula and can precisely control our growth which we have been proving consistently over the past 18 months. We will further increase our investment into marketing & sales especially in the light of the new financing and the fact that our growth yields return. Given our momentum, we will steer more into our social investing experience and maintain our advantages over competition. Growing our user base and increasing transactional activity will become increasingly relevant strategic metrics in 2021.”

NAGA Group AG share price chart, past six months. Source: Google Finance.