Robinhood introduces Robinhood Investor Index

Today, Robinhood introduces the Robinhood Investor Index to show how its customers are investing.

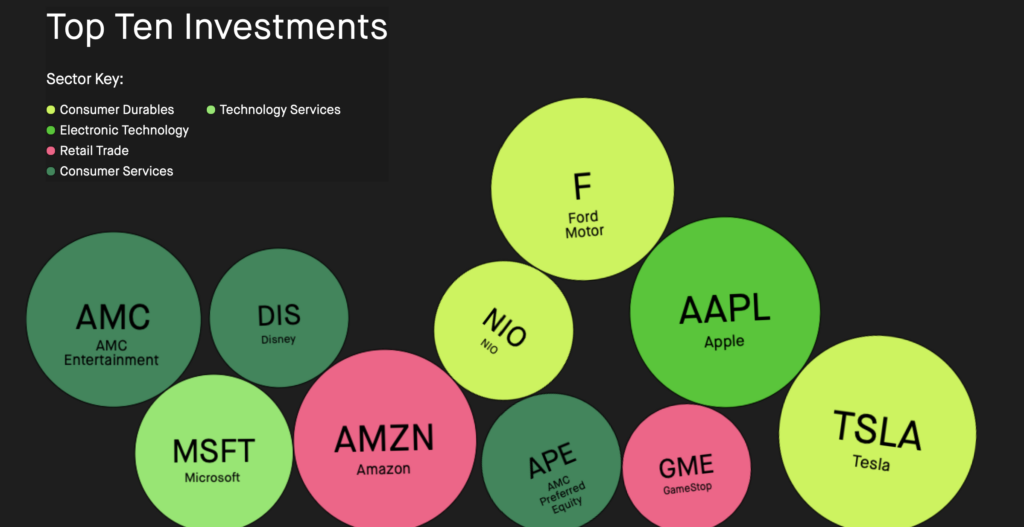

The Robinhood Investor Index is an aggregate view of Robinhood’s customers’ top 100 most owned investments on Robinhood and tracks the performance of those investments over time. Unlike most other indices, it is not weighted by dollars, but by conviction.

Robinhood says that it measures a customer’s conviction for each investment by looking at the percentage it makes up of their portfolio. And to ensure that all customers are equally represented, Robinhood averages conviction for each investment across all customers, whether they have $20 or $20 million in their account.

Robinhood will update the index once a month and plan to share valuable insights about where its customers are investing their money. Here is some data the company has gathered so far:

- Robinhood customers invest in what they know, understand and believe in for the long-term. Staples in daily lives, like Microsoft, Apple, and Amazon, are consistently some of the top holdings.

- Customers have grown their commitment to the electric vehicle revolution with Tesla at the top, while expanding to Ford and NIO, among others, moving them up the ranking.

- Entertainment is also a theme, with Disney and AMC consistently among the top securities.

- Overall, the index leans towards large cap stocks with 75% in large cap, 16% in mid cap and 9% in small cap.

- Looking at the sector representation, it is quite diversified, also spanning financial services, energy and healthcare.