Exclusive: UK share brokers petition FCA over CFD broker tactics

FNG Exclusive… FNG has learned that several UK online shares brokers have been pushing the FCA to intervene and enact stricter rules for CFD brokers. Or at a minimum to better enforce existing rules.

The shares brokers are claiming that not all CFD brokers are following the rules of posting required risk disclosures regarding leveraged CFD trading. All brokers offering leveraged FX and CFD trading in the UK (and EU) must post highly visible warnings about the risk of leverage on all websites and marketing material, as well as disclosure about what percentage of clients lose money.

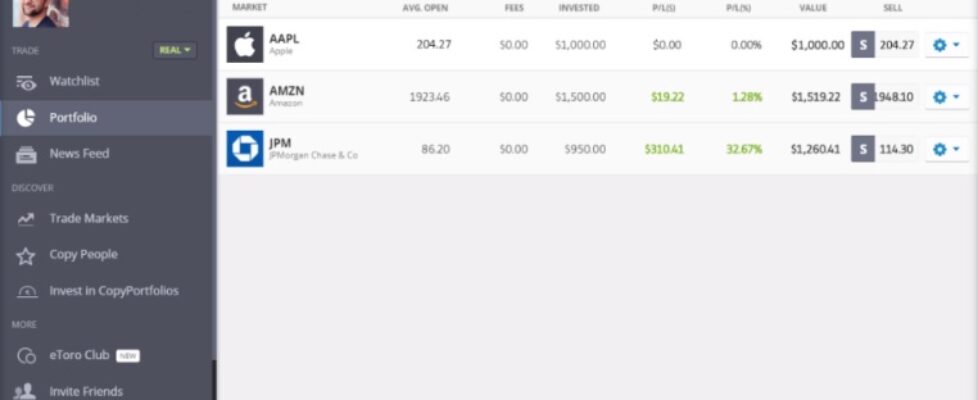

Also, and more worrisome according to the shares brokers, is that CFD brokers are increasingly offering share dealing services and wrappers like a shares ISA that are marketed to a wide segment of retail investors. However, they claim, these brokers are offering their CFD services alongside share dealing services on apps and web portals, often in ways that could potentially lead retail investors to inadvertently purchasing a more risky leveraged CFD product.

The move comes as competition has increased significantly over the past 12 months between CFD (or “Forex”) brokers, and shares brokers. CFD brokers as a whole had a tremendous 2020, driven by unprecedented market volatility in the wake of the global COVID-19 pandemic. One of the changes CFD brokers saw last year, beyond record trading volumes and new client signups, was a shift from FX pair trading to equity CFD trading, as global equity markets rallied the entire second half of 2020. And, as a younger generation of traders became enamored with stocks they are familiar with – and which did great in 2020 – such as Amazon, Netflix, Tesla, Peloton, Apple, Zoom…

Some CFD brokers are indeed offering low or zero commission “real” stock trading alongside their CFD offerings, such as eToro and UK online market share leader IG Group.

The shares brokers are also somewhat upset that they are appearing in trading-comparison websites frequented by retail traders alongside the CFD brokers. While these sites are run by third parties not connected to either group of brokers, the shares brokers say that the comparisons are unfair and mislead retail investors into believing that the risks are similar with either group.

According to rules put in place by UK financial regulator the FCA in August 2018, as well as by all European Union countries under the guidance of ESMA, CFD brokers can offer leverage of up to 5x (i.e. minimum 20% margin required) in effecting equity CFD trades. And, there are no margin calls in CFD trading – the broker can leave a losing leveraged position open until the trade hits zero. (On the flipside, CFD broker clients are afforded negative balance protection, and cannot lose more money than they deposited with the CFD broker).

Trading with share brokers, by contrast, is more limited in that initial trades can be done with a maximum of 2x leverage (i.e. 50% margin), and the client will receive a margin call if losing positions result in margin dropping below 25% (i.e. 4x leverage). Some shares brokers do not offer clients any leverage.

FNG spoke with Richard Wilson, CEO of shares broker Interactive Investor – one of at least two shares brokers which have confirmed that they have written letters to the FCA on the matter (the other being Freetrade), who said:

FNG spoke with Richard Wilson, CEO of shares broker Interactive Investor – one of at least two shares brokers which have confirmed that they have written letters to the FCA on the matter (the other being Freetrade), who said:

“The opaque operating models of firms involved in spread-betting and CFDs pose a risk of harm to UK retail investors.

“We are concerned that these providers often position themselves as direct competitors of traditional D2C investment platforms. Their customers could find themselves inadvertently investing into complex derivative products rather than the actual assets. The commercial interests and the risks to the consumer are not made particularly clear and are potentially hidden behind the headline claim of 0% commission.”

A spokesperson for Freetrade.io noted the following:

A spokesperson for Freetrade.io noted the following:

“More robust measures are required to protect retail investors from the harm that can result from inexperienced investment in leveraged derivative products, like CFDs. We are deeply concerned by the aggressive marketing tactics being deployed by some CFD brokers to target retail customers. The protections currently in place are insufficient and subject to abuse, while the regulator does not appear to be able to police these practices effectively.”