Swissquote registers drop in revenues in 2022

Leading Swiss online trading firm Swissquote today posted its financial metrics for the year to December 31, 2022.

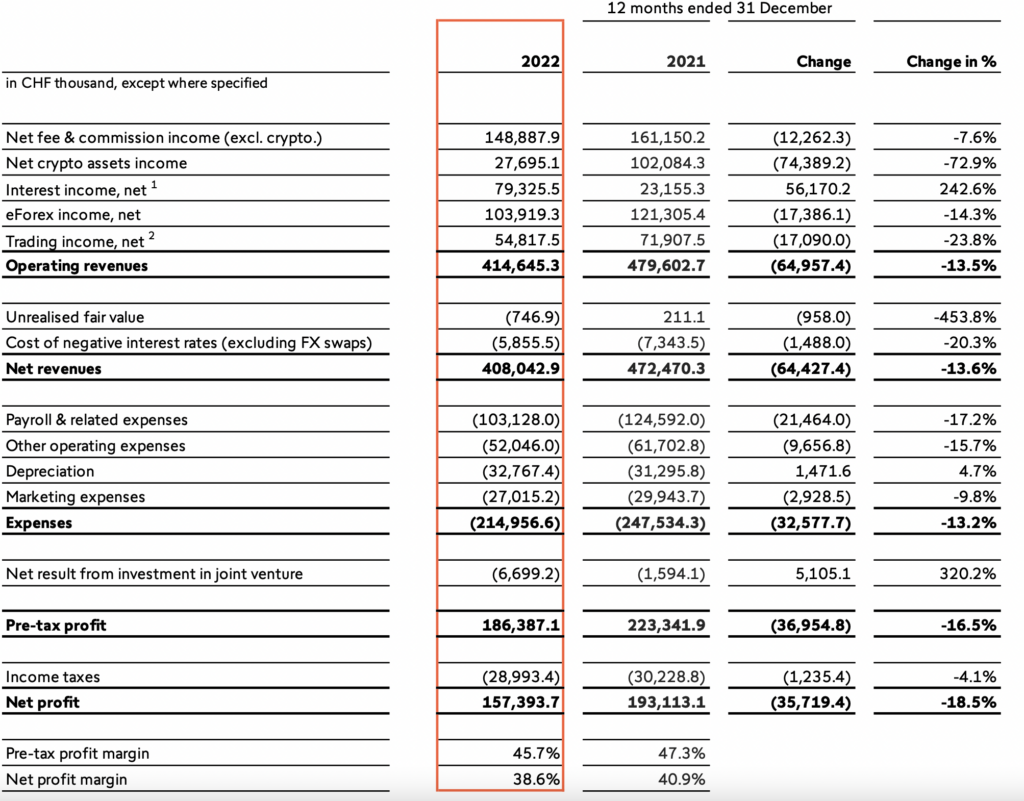

Operating revenues totalled CHF 414.6 million, a decrease of 13.5% compared with the previous year (CHF 479.6 million), reflecting the difficult market conditions. Net revenues of CHF 408.0 million (CHF 472.5 million) were similarly 13.6%, but still amount to the second-highest result ever.

The second half of the year 2022 was improved over 1H-2022 at Swissquote, with both Net Revenues (CHF 208 million vs CHF 200 million) and Net Profit (CHF 80.3 million vs CHF 77.1 million) increasing by 4%.

Net fee and commission income decreased by 7.6% as the share of non-transaction based revenues was able to compensate for the slowdown in trading activity. Net eForex income decreased by 14.3 percent, due to lower volumes. Net crypto assets income was impacted significantly by the crypto market turmoil, declining 72.9 percent to CHF 27.7 million (6.8 percent of net revenues).

On the other hand, net interest income increased by 242.6 percent due to rising interest rates across major currencies. Specifically, the CHF policy rate moved from a negative 0.75 percent to a positive 1.0 percent reference rate at the end of 2022.

Net trading income decreased by 23.8 percent as a result of lower turnover in asset classes traded in foreign currencies.

Pre-tax profit decreased by 16.5 percent to 186.4 million (CHF 223.3 million), while the pre-tax profit margin remained at a high level of 45.7 percent (47.3 percent) despite a 13.6 percent decline in net revenues. Net profit decreased to CHF 157.4 million (CHF 193.1 million), and net profit margin to 38.6 percent (40.9 percent).

Trading volumes decreased during the second half of the year at Swissquote, with client eForex trading volumes averaging $109 billion monthly in 2H-2022, versus $124 billion monthly in 1H-2022. In all of 2021 Swissquote averaged $128 billion in monthly trading volumes.

A total of 51,099 new client accounts were opened in 2022 (of which 8,000 inorganic), most of them trading accounts, bringing the total number of clients above the 500k threshold for the first time. About 60% of the net new monies came from outside of Switzerland, showing the growing penetration of the Swissquote brand. Thanks to the UEFA sponsorship, the Swissquote brand is broadcasted in over 200 countries globally, across hundreds channels, with millions views.

The total number of accounts reached 538,946 (+10.5 percent) by the end of 2022, with deposits averaging almost CHF 100,000 per customer. Strong net new monies of CHF 7.7 billion (of which 1.7 billion inorganic) partly compensated for the market-generated decrease in client assets from CHF 55.9 billion to CHF 52.2 billion (down 6.6 percent).

Generally, all asset classes saw decreases in value in 2022, but the customer base remained steadily invested even in high-risk asset classes. As of 31 December 2022, total crypto assets under custody declined to CHF 1.0 billion (CHF 2.8 billion) despite the fact that customers have increased their holdings in major crypto assets (5.7 percent increase).

As of 31 December 2022, the balance sheet remained strong and all regulatory ratios were solid (e.g. liquidity ratio at 496%). Thanks to its capital ratio of 24.8 percent (26.2 percent), well above the regulatory limit of 11.2 percent, Swissquote is well-positioned to capture internal and external growth opportunities (as it did with the acquisition of Keytrade Bank Luxembourg SA in 2022).

The Board of Directors will propose to the Annual General Meeting an unchanged dividend of CHF 2.20 per share, corresponding to 21 percent of the net profit for 2022.

Swissquote announces the following changes to its corporate organisation:

- Esther Finidori will be proposed as a new member of the Board of Directors at the upcoming Annual General Meeting. She is currently Vice President Strategy at Schneider Electric, where she is in particular in charge of sustainability. Esther Finidori has developed a strong expertise in sustainability in general and in environmental aspects and digital transformation specifically, of which Swissquote’s Board of Directors will highly benefit in case she is elected.

- Lino Finini, who currently holds the position of Chief Operating Officer, will be stepping down as a member of the Executive Management effective 31 December 2023 to take retirement.

The 2023 Annual General Meeting will be held at the Swissquote headquarters, in Gland. On this occasion, the Board of Directors will propose a series of revisions to the Articles of Association, to bring them into line with the revised Swiss Code of Obligations that entered into force on 1 January 2023. The Board of Directors will in particular propose the creation of a capital band valid for a period of five years, which will replace under similar terms the current authorised capital. The latter will expire on 6 May 2023 and is no longer renewable under the revised Swiss Code of Obligations.

Going forward, Swissquote is targeting net revenues of CHF 495 million (plus 21 percent) and a pre- tax profit of CHF 230 million (plus 23 percent) for 2023. Despite a cautious stance, Swissquote ex- pects to deliver all-time high results in 2023.

Swissquote’s medium-term target for 2025, i.e. an pre-tax profit at CHF 350 million, is confirmed.