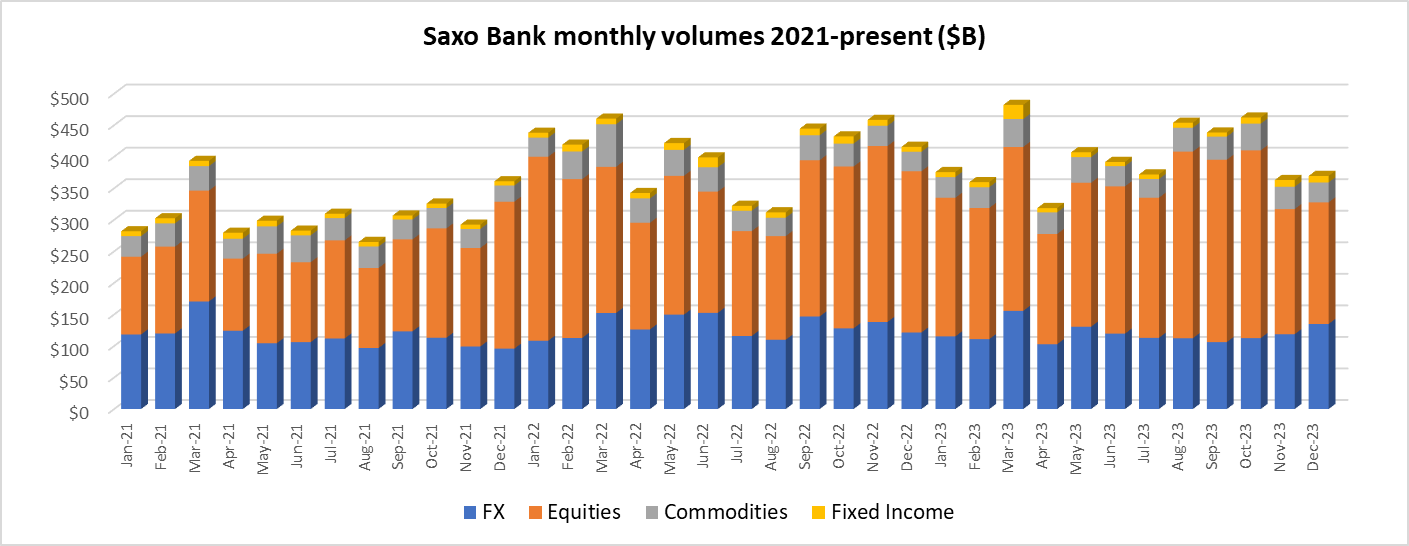

Strong FX trading sends Saxo Bank volumes up 2% in December 2023 to $369.5B

Copenhagen based Retail FX and CFDs broker Saxo Bank closed out 2023 on a positive note, posting a 2% month-over-month increase in client trading volumes in December 2023, led by strong core FX trading activity.

FX trading volumes for December came in at $134.8 billion at Saxo Bank – its highest level since March. That more than offset slight declines in trading in Saxo Bank’s other asset classes, resulting in an overall 2% rise in activity to $369.5 billion for the month.

For all of 2023 Saxo Bank averaged $399.4 billion in monthly client trading volumes, down slightly by 1.5% from 2022’s $405.4 billion.

Client trading volumes at Saxo Bank in December 2023 were as follows:

- FX trading up 14% MoM to $134.8 billion.

- Equities down 3% to $192.8 billion.

- Commodities down 11% to $31.6 billion.

- Fixed income trading down 3% to $10.3 billion.

Saxo Bank is controlled by China’s Geely Group.