StoneX authorizes repurchase of up to 1 million shares

StoneX Group Inc (NASDAQ:SNEX), a diversified global brokerage and financial services firm, has filed an 8-K document with the Securities and Exchange Commission (SEC) regarding its share repurchase plans.

The Board of Directors of StoneX Group Inc. has authorized the repurchase of up to 1.0 million shares of its outstanding common stock from time to time in open market purchases and private transactions for the period between December 23, 2020 and September 30, 2021. These purchases will be subject to the discretion of the senior management team to implement the company’s stock repurchase plan, and subject to market conditions and as permitted by securities laws and other legal, regulatory and contractual requirements and covenant.

During fiscal 2020 and 2019, StoneX, formerly known as INTL FCStone, repurchased 200,000 and 100,000 shares of its outstanding common stock in open market transactions, for an aggregate purchase price of $7.5 million and $3.8 million, respectively. During fiscal 2018, the company had no repurchases of its outstanding common stock.

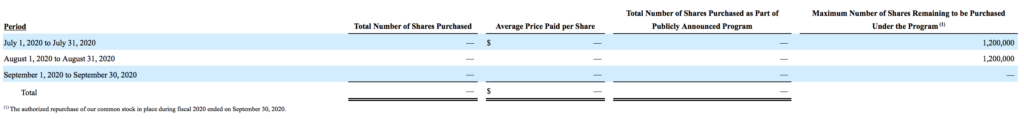

On August 13, 2019, StoneX’s Board of Directors authorized the repurchase of up to 1.5 million shares of StoneX’s outstanding common stock from time to time in open market purchases and private transactions, commencing on August 14, 2019 and ending on September 30, 2020. The repurchases were subject to the discretion of the senior management team to implement the stock repurchase plan, and subject to market conditions and as permitted by securities laws and other legal, regulatory and contractual requirements and covenants.

StoneX’s common stock repurchase program activity for the three months ended September 30, 2020 was as follows: