“Short squeeze” lawsuit plaintiffs slam Robinhood, Citadel Securities for PFOF

Less than a month after Citadel Securities responded to the complaint brought by investors who suffered heavy losses during the January “short squeeze”, the traders have also filed their response.

In fact, a number of documents were filed by the plaintiffs in the multi-district litigation on September 21, 2021. These documents include not only the response to the defendants’ motion to dismiss the antitrust tranche complaint, but also several amended complaints. FX News Group has examined the response and the corrected complaint in the antitrust tranche, so that more details are provided to the readers.

Evidentiary details would be important as the motion to dismiss attacks the complaints on several grounds, with the main one being that the complaint fails to set forth allegations of an anticompetitive agreement.

The traders say that the defendants are incorrect, as the complaint “is replete with facts which when proven at trial will constitute evidence—both direct and circumstantial—that Defendants entered an anticompetitive agreement to restrict the Relevant Securities”.

The plaintiffs explain that this case is about individual investors who invested their money in the stock market and were stripped of their rights to control their own investments. The traders accuse the defendants and other market players of hatching an anticompetitive scheme to restrict Retail Investors’ access to the stock market and prevent the market from operating freely and fairly.

According to the traders, the defendants did so to protect each other, and to stop the hemorrhaging losses incurred by the Market Maker Defendants as a result of their accumulation of large short positions.

The plaintiffs in this case claim to represent:

All persons or entities in the United States that held shares of stock or call options in GameStop Corp. (GME), AMC Entertainment Holdings Inc. (AMC), Bed Bath & Beyond Inc. (BBBY), BlackBerry Ltd. (BB), Express, Inc. (EXPR), Koss Corporation (KOSS), Nokia Corp. (NOK), Tootsie Roll Industries, Inc. (TR), or Trivago N.V. (TRVG) as of the close of market on January 27, 2021, and sold the above-listed securities from January 28, 2021 up to and including February 4, 2021 (the “Class Period”).

The plaintiffs seek to prove the alleged conspiracy. They note that the industry is close-knit and built on preexisting relationships. Additionally, individuals within the industry frequently move from one market participant to another or invest financial resources in other market participants.

Citadel Securities’s Head of Execution Services, for instance, the plaintiffs say, had prior working relationships through FINRA with Josh Drobnyk, Robinhood’s Vice President of Corporate Communications during the relevant period.

According to the traders, as a result of the close-knit nature of the industry and the prior relationships developed by those within the industry, there are a high number of interfirm communications which tend provide opportunities to exchange information and to render a market susceptible to collusion. Given the events of late 2020 and January 2021, the participants in the conspiracy had numerous opportunities to conspire to restrain trade.

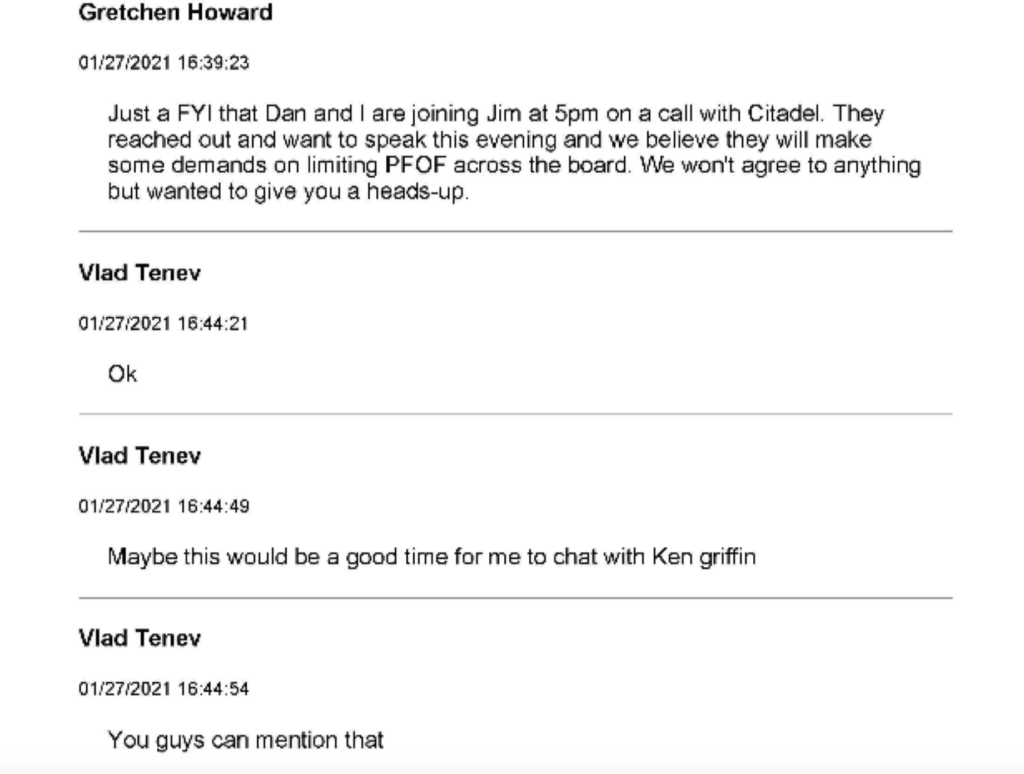

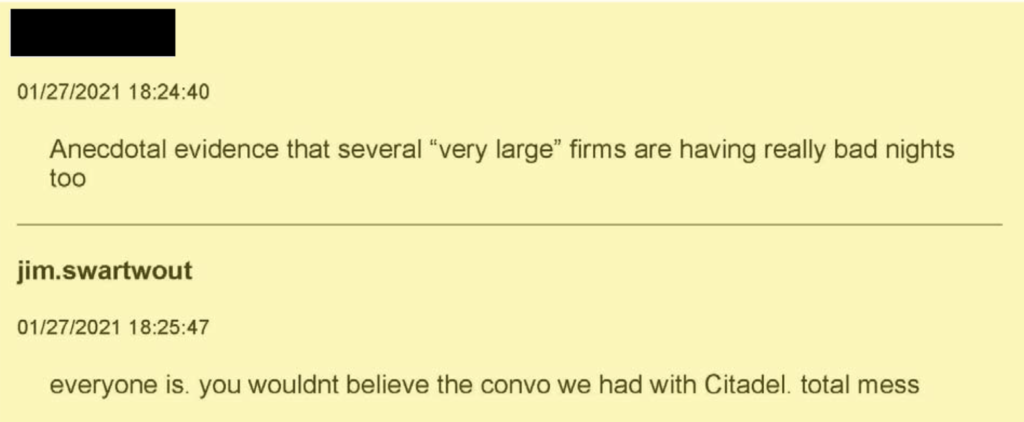

The traders note that high level executives of Citadel Securities and Robinhood coordinated communications in the weeks before, and numerous times the day before, the restrictions were ultimately imposed.

Additionally, Robinhood’s Drobnyk appeared to accept Citadel Securities’s proposition made on January 20, 2021. Also, high level employees of E*Trade and Citadel Securities exchanged communications throughout January 28, 2021 to confirm certain orders were cancelled.

The plaintiffs admit, however, that while high-level employees of Citadel Securities and Robinhood coordinated communications via email or via internal chat channels, the emails appear cryptic with little indication about the subject matter communicated between the participants, reserving substantive discussions of their dealings to unrecorded telephone calls.

On January 27, 2021, the day before the restrictions were implemented, high level employees of Citadel Securities and Robinhood had numerous communications with each other. According to the plaintiffs, this indicates that Citadel applied pressure on Robinhood.

The plaintiffs argue that Citadel Securities stood to gain from stopping the short squeeze by purchasing new short positions at the peak of the Relevant Security price increase and then profiting from the artificial decrease in share price after the trading restriction on January 28th.

The traders say:

“While there is no publicly available data to show that Citadel Securities was one of the parties that opened up new short positions on January 25 – recall there is no requirement that hedge funds disclose their short positions except as described above – it would be in Citadel Securities’s best interest to open up new short positions if Citadel Securities planned to leverage its relationships to halt trading of GameStop and other Relevant Securities and artificially depress their share price”.

Further, according to the traders, given Robinhood relies on payment for order flow for revenue, and sold a significant portion of its order flow to Citadel Securities, the two firms had motive to cooperate due to their close economic relationship. Indeed, in several internal conversations, high level executives of Robinhood and Citadel Securities stated the firms had a “strong relationship” and that the relationship was a “partnership.”

The plaintiffs add that the Clearing Defendants had reason to participate and join in the conspiracy. NSCC is a member driven corporation. Member clearing agents report the trades they receive to their parent organization, the DTCC. The DTCC then ensures the transfer of money to the seller’s broker account and the transfer of security ownership to the buyer’s broker account. To mitigate the risk of settling trades, the DTCC requires that NSCC member clearing firms put up collateral, which the NSCC member clearing firms typically pass down to brokerages.

The DTCC collateral requirement changes depending on the perceived risk of the order, since if one side of the trade defaults, and the broker cannot cover the loss, DTCC member firms are on the hook for completing the trade. In other words, if a member became bankrupt, DTCC and its member clearing agents would be on the hook for the short positions taken by that member.

Robinhood’s CEO Vladimir Tenev also testified before the Congressional House Committee on Financial Services that Citadel Securities’s payment for order flow revenue is Robinhood’s primary source of revenue.

The traders state:

“This essentially proves that Robinhood’s client is not the retail investor themselves, but rather Citadel Securities. In this relationship, it is actually the retail investor who is Robinhood’s product; the product for which Citadel Securities is in fact buying and paying Robinhood a premium.

The traders add that Robinhood is not alone in profiting from payment for order flow. Every Brokerage Defendant, Apex, and ETC sell order flow. Additionally, Citadel Securities is either the largest or one of the largest payors for order flow for most of them”.

According to the plaintiffs, Robinhood and other broker dealers had every motivation to join the anticompetitive scheme to restrict trading to benefit their real clients: the clearing agents and the Market Maker Defendants.

“Robinhood has gamified the investing market to funnel young investors onto their platform, ultimately to offer the Market Maker Defendants a birds’ eye view of both sides of their trades, enabling companies like Citadel to benefit from simultaneously making and playing the market” – the traders argue.

The lawsuit continues at the Florida Southern District Court. The amended complaints just filed by the plaintiffs will be discussed by the parties at a status conference scheduled for September 23, 2021.

Anonymous

September 23, 2021 @ 5:52 am

4.5

Anonymous

September 23, 2021 @ 7:39 am

5

Anonymous

September 23, 2021 @ 7:58 am

3

September 23, 2021 @ 2:53 pm

Trust me they talked to one another (broker and their puppet masters). I have photo proof of Webull saying it was their clearing house that stopped fair trade in the middle of the day. There was no buying of the security (i was in koss) allowed while they allowed the sell side of the transactions to continue.

As for the statement that those lawyers represent “all” of the group done wrong during that very specific time frame… It me realize 2 things. One they know exactly the time frame they broke the law Plaintiffs don’t care about time frame only the defense and have no need to add that. Makes me think that after the ruling no one under the timeline can have a favorable outcome going forward.

Second thing is that who the heck are these lawyers! I never even spoken to them, I’m in Illinois. How can he/she represent me when he/she doesn’t even have my photographic proof? So the fact that they said they represent “all” of us. Tells me justice will be blindsided by a smart setup.

I’m guessing brokerages will get a billion dollar fine (slap on the hand), big speeches how they will make things better at the SEC, and that justice is served while I get back 10 percent (if any) of my losses.

I’ll be referencing this clip on Reddit. Thanks for the piece.

September 23, 2021 @ 3:03 pm

Hi Mark! Thank you for the detailed comment.

Regarding your remarks about the lawyers, I just wanted to add that the lawyers can be changed during the course of the lawsuit. Also, the class of plaintiffs is putative at this point, meaning that there still has to be precision about who the actual plaintiffs are (the Court has not yet certified the class). I also remember a big argument about who the lead plaintiffs and their counsel should be. I suppose you are not the only one who believes he is not represented correctly.

On a personal note, I can share that the counsel for the antitrust tranche claims to have made an error by filing the amended complaint on September 21, 2021. The counsel filed another one (I don’t see much difference between the two) 20 hours after this article was posted. I expect the Judge will scold the lawyers today about the mess with the complaints. Such errors may be used by the defendants to challenge the case.

I’ll keep an eye on this topic. Take care.

September 24, 2021 @ 2:44 am

Failed to mention all the media outlets bashing AMC constantly everyday trying to get investors to sell their stocks. The amount of failures to deliver stocks.The dark pool volume is over 60 % of trades going to the non-lit exchanges. Short ladder attacks and the other ways they manipulate the stock market. Example there’s always a pump and dump stock every morning that only certain people get wind of and make a huge amount of profits in these fake companies that don’t even have employees most of the time.

September 24, 2021 @ 2:05 am

I attempted to write a lond/detailed email discussing how robinhood …for years has illicitly loaned shares of its clients stock to short sellers …without disclosing the transaction..nor sharing the proceeds with its clients

It is likely the fees collected are tremendous and might parallel the fees for order flow

Still a client buys stock believing it should go up..but no..robinhood would loan same shares to a short seller..for profit..negating in essence the purchase

I was led to this knowledge from a Sewell Lee of Finra..who could virtually prove same from finra printouts

A jacob frenkel attorney was ready to take on case if I were the party suing..then backed off

Writers from business week and Washington post were ready to explore the practice and illicit naked shorting by market makers…always ending with citadel securities

All name can be provided..but I believe this should be added to case at hand..because the collusion is far deeper than expected or suspected

Please reach out and we can talk

Your case here is worthwhile …but there is also a whistle blower cause of action..easily provable with the SEC with potential damages. In the billions of $

September 24, 2021 @ 12:58 pm

Great bit of Journalism Maria, I read another one of your articles earlier in the year. Keep up the good work.

September 24, 2021 @ 1:24 pm

Thank you, Darren! However, this article is far from perfect. As I mentioned in one of my earlier comments, the plaintiffs’ counsel filed another complaint about 20 hours after the article was published. And although the new complaint does not require changes to the contents of the present article, the newly filed document still needs to be taken into account. For instance, one of the screenshots (the one with Vlad Tenev’s chat) is amended with one more line added to it. It states that Vlad Tenev has not met Ken. So, I will need to consider that extra info in my future articles, in order to provide the readers with truthful reports about the case.

Stay safe 🙂

Anonymous

September 29, 2021 @ 9:29 pm

0.5