Saxo Bank reveals equity themes that worked well in 2021

Peter Garnry, Head of Equity Strategy at Saxo, has published an interesting analytical piece on the equity themes that performed well last year, drawing some inferences on how this information can help investors make decisions in times of increasing inflation.

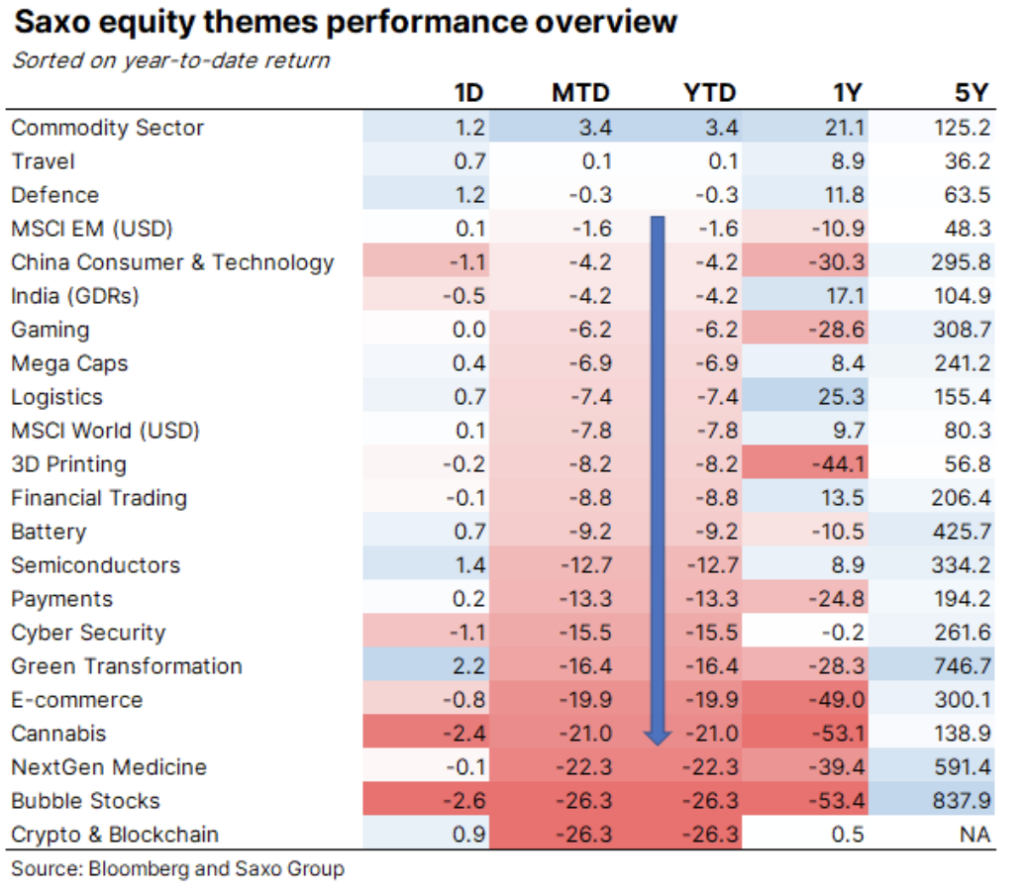

In today’s equity note we show what equity themes have worked well over the past year with rising inflation and interest rates and it is clear that portfolios consisting purely of growth stocks must diversify into themes such as commodity sector, logistics, semiconductors, financial trading, mega caps, travel and defence. Adding these themes will diversify equity portfolios and make them able to absorb inflationary pressures while also reducing the sensitivity to higher interest rates.

The impact on equities from higher inflation and interest rates have been felt across our Bubble Stocks, NextGen Medicine, E-commerce, Green transformation, Gaming, Payments, and 3D Printing theme baskets. The denominator for all of these themes have been excessive expectations and thus prohibitively high equity valuations.

As Saxo’s theme baskets also show, during times of rising inflation expectations and interest rates, themes such as the commodity sector, logistics, semiconductors, financial trading, mega caps, travel and defence have done well.

“We also believe the cyber security basket could be added as an inflation basket as cyber security is less correlated to the economic cycle because it has become a necessity and thus the industry has pricing power”, Peter Garnry says.

Saxo’s Commodity Sector basket is particularly interesting this year being the best performing basket up 3.4%. Given the bloodbath in growth stocks having had exposure to commodities would have shielded some of the impact from the Fed’s December pivot on interest rates and inflation. Saxo’s view is that most retail investors have a too high exposure to growth stocks but instead of panicking and selling their stocks they should instead balance their portfolios across components that can do well during inflation.

Another interesting theme during rising interest rates and inflation are financial trading firms. These companies benefit from higher interest rates which in turn creates more market volatility which they also benefit from. In Peter Garnry’s view, financial trading firms will add great diversification to equity portfolio during inflationary pressures.