Robinhood shares fall (another) 15% after weak Q4 results and Q1-2022 outlook

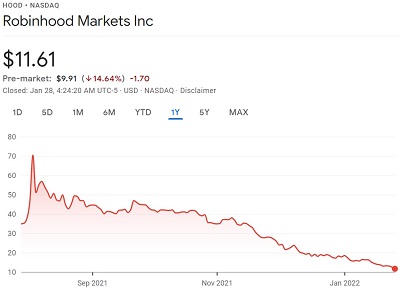

Online broker Robinhood (NASDAQ:HOOD) saw its shares plummet by 15% in after hours trading Thursday and pre market trading Friday morning, after the company reported weak Q4 results and a tepid outlook for Q1-2022.

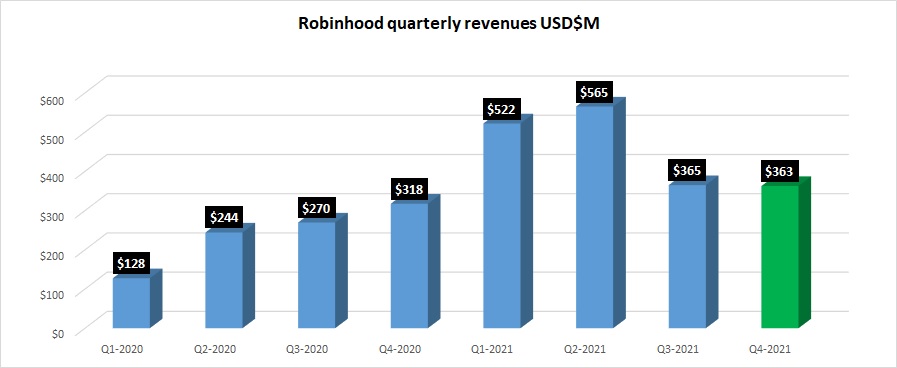

As far as its results go, Robinhood reported Q4 revenues of $363 million, down slightly (0.6%) from Q3. The company, lost $423 million in Q4, and $3.7 billion for the full year 2021 – losses which were supposed to fuel the rapid growth of the company.

Robinhood’s revenues from client crypto trading in Q4 were $48 million, which investors also found disappointing as crypto trading had fueled much of Robinhood’s growth to date. However what seemed to most irk shareholders was the company’s financial outlook, which stated that for the current Q1-2022 Robinhood anticipates that revenues will be less than $340 million – and even that assumes some incremental improvement in trading volumes versus what the company has seen so far.

Another worrying factor growth-wise was an 8% QoQ decline in Monthly Active Users at Robinhood, down to 17.3 million for December 2021 compared with 18.9 million in September 2021.

The 15% post-report share price drop followed a 6% fall in HOOD during Thursday’s regular trading session. At its pre-market price of $9.91, Robinhood shares are now down 74% from their $38 IPO price in July, and are off a whopping 88% from their $85 peak set in the weeks following the IPO. At the current price Robinhood’s market cap is $8.5 billion.

The 15% post-report share price drop followed a 6% fall in HOOD during Thursday’s regular trading session. At its pre-market price of $9.91, Robinhood shares are now down 74% from their $38 IPO price in July, and are off a whopping 88% from their $85 peak set in the weeks following the IPO. At the current price Robinhood’s market cap is $8.5 billion.

While Robinhood has been beset by a number of lawsuits in recent months stemming from client trading around what is now known as the January short squeeze as well as misleading quotes in its IPO documentation, its real problems seem to be financial – the company is losing money while not really growing. And things aren’t necessarily going to get better any time soon. Robinhood’s outlook added that in fiscal 2022 it expects total operating expenses to increase 15-20% year-over-year.