Saxo Bank launches equity basket focusing on cyber security sector

Multi-asset investment company Saxo Bank announces the launch of its 16th equity basket – it focuses on the cyber security industry. This industry has grown considerably the past year and delivered strong returns to shareholders over the past five years. Saxo notes that the best feature of the cyber security industry is that it has defensive characteristics combined with an above average growth outlook.

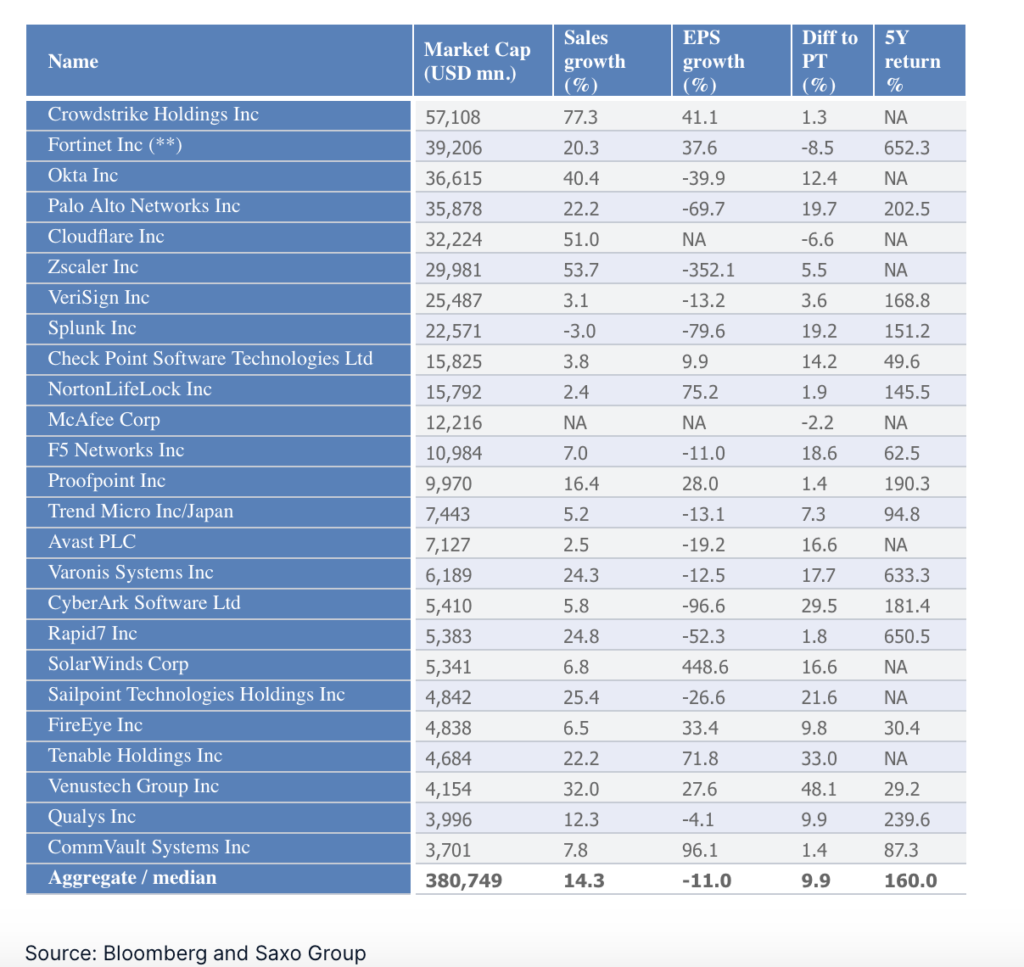

Saxo’s cyber security basket consists of 25 companies mainly based in the US with only three non-US companies showing the dominance of the US in cyber security. Despite the growing threats from cyber attacks with the most recent high-profile attack being on a major US pipeline, the industry is still small with a combined market value of $381bn across the 25 companies in our basket.

The cyber security industry is expected to grow 11% annualized until 2028 from a current estimated market size of $167bn, but this could prove to be too low an estimate given the increased threat from cyber attacks. With the adoption of Internet of Things which Saxo back in May described as the next growth cycle for the semiconductor industry more things will be coupled and connected creating even bigger demand for cyber security.

Saxo’s Head of Equity Strategy Peter Garnry notes that many cyber security stocks are aggressively valued due to increased attention of investors and the growth outlook. These high valuations make cyber security vulnerable and more volatile over earnings releases as they respond more to the changing outlook. The high valuations also mean that cyber security stocks in the short-term could be sensitive to higher interest rates.

He also warns that cyber security technology is evolving fast, and some companies might not be able to switch to the new technology vectors.

Saxo Bank has been regularly adding new baskets to its offering. Its 15th equity theme basket provides a diversified exposure to the global logistics industry. This is the biggest basket Saxo has done to date, as the industry is very large and complex, consisting of 50 stocks across a wide range of logistics services from sea, land, integrated, application systems and storage/warehouses.