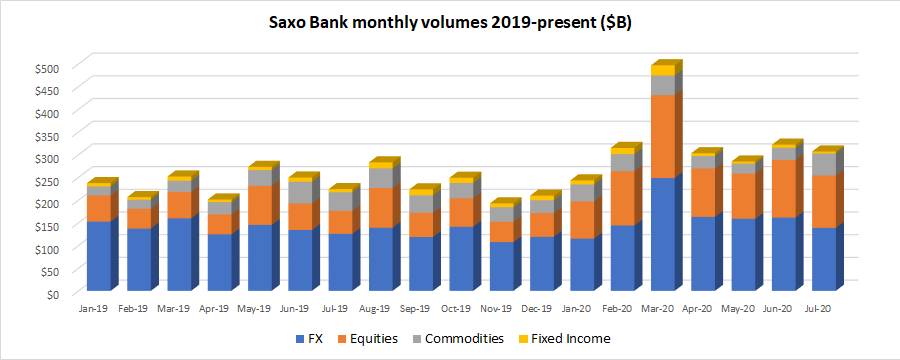

Saxo Bank July FX trading volumes down 14% at $138.6B

The summer slowdown in FX trading is here, and with it a number of the leading retail and institutional forex and CFD brokers are reporting less trading activity for the month of July.

Copenhagen based multi asset broker Saxo Bank, which somewhat straddles the retail and institutional realms, has reported that overall client trading volumes in its system were down 5% MoM in July, to $307.1 billion. That includes a 14% drop in FX trading volumes, Saxo’s largest asset class, to $138.6 billion.

What saved Saxo’s month somewhat was commodities trading, which was actually up 81% over June, at $48.6 billion. That makes July 2020 Saxo’s best ever month for commodities trading, driven mainly by the continued rise in Gold prices to all-time highs. Gold trading has become very popular among retail traders over the past few months, since central banks worldwide started flooding the markets by printing cash.

In summary, Saxo trading volumes during July (with % change comparisons to June):

Commodities $48.6 billion (+81%)

Equities $115.4 billion (-9%)

Fixed Income $4.4 billion (-35%)

FX $138.6 billion (-14%)

Total volume $307.1 billion (-5%)