Saxo Bank introduces new lower pricing and custody fees

Online trading and investment specialist Saxo Bank is introducing new lower pricing and custody fees.

To begin with, the company has lowered its monthly custody fees by up to 40%.

Saxo also offers its clients to save up to 92% on non-US stock CFDs. In an efforts to keep its pricing ultra-competitive, Saxo is lowering its prices significantly – up to 92% – on single stock CFDs on non-US markets such as Europe, Asia or Africa.

The commissions on bonds are also reduced. Clients of Saxo Bank can save up to 75% on commissions when they trade online or offline bonds.

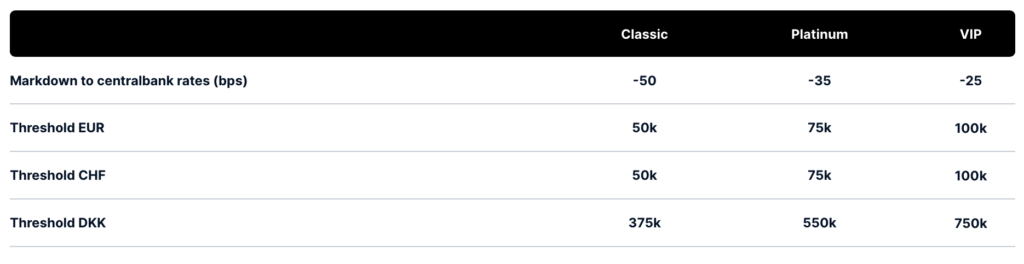

The bank has also introduced lower thresholds on negative interest rates and adjusted rates.

Negative interest rates have been with us for several years and the threshold for negative interest rates is being further lowered across the world. Please note that the following thresholds and rates apply for new approved accounts from 25.11.2021. For existing customers, these new rates and thresholds will apply from 1.2.2022.

Saxo advises its clients who have cash holdings in EUR, CHF or DKK above the thresholds to consider alternative strategies for their money. Saxo offers a wide range of investment products, including stocks, bonds, mutual funds or SaxoSelect managed portfolios.

Saxo clients can also choose to convert part or all of their cash holdings into other currencies which do not incur negative interest.

Let’s note that Saxo Markets has recently launched pricing plans for its clients in Singapore. Singapore is the first international market where Saxo is rolling out its pricing plans, with more markets to follow in the future.