Robinhood valuation hits $11.2B as Congressman looks for more regulation

Online brokerage sensation Robinhood is not only helping create some of the multi-billion-dollar companies out there as its trader community pushes into stocks like Tesla and Amazon – it is becoming one itself.

The Silicon Valley based Robinhood announced today that it has raised a further $200 million in Series G funding at a valuation of $11.2 billion from private/public crossover investor D1 Capital Partners – possibly hinting that Robinhood itself will soon be on its way to becoming a public company.

The announcement comes just a month after the company announced the closing of its Series F funding which raised $320 million for Robinhood at an $8.6 billion valuation. That computes to a more than 30% jump in valuation for Robinhood in just five weeks.

The company’s latest valuation is fairly close to the price that rival E*Trade is being acquired for by Morgan Stanley. That stock-for-stock deal, expected to close later this year, currently values E*Trade at just over $12 billion.

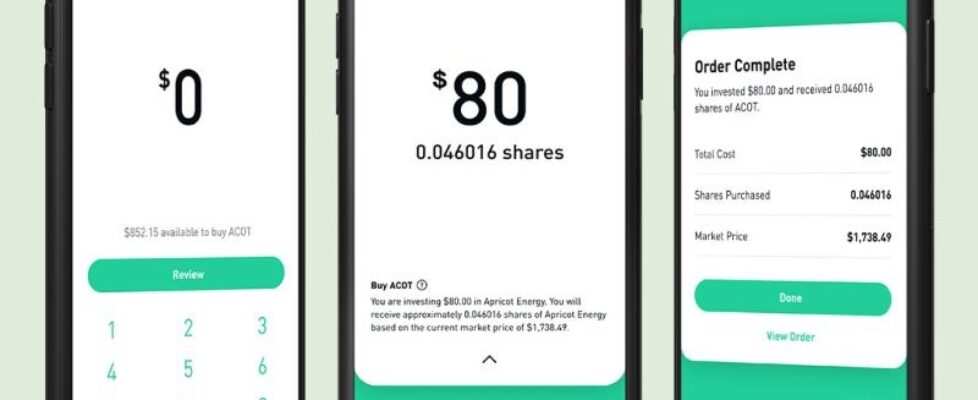

Robinhood stated that with this new funding it will continue to invest in improving its core product and customer experience. The company went on talk about educating traders, and increasing its customer service.

However the company is doing so amid an increasing amount of criticism. Robinhood has suffered a number of technology outages, and recently cancelled plans to expand to the UK so that it could (mainly) focus on fixing and improving its offering at home in the US.

And today, Democrat Congressman Sean Casten went on CNBC (see video below) which ran the banner “Unethical?” at the outset of the interview, discussing his views on fundamental problems with Robinhood and what regulators should be looking at in general. Congressman Casten stated that Robinhood’s business model is:

“fundamentally based on creating addictions, that is being presented to people as a way to generate wealth.”

He stated that the company (as well as a number of competitors) use behavioral techniques to get clients to “go a little bit farther”.

While he did note that he believed that Robinhood was operating fully within the letter of the law, he said that this fact highlights that regulators need to take a closer look at rules that are meant to protect investors. As an example he cited the large amount of leverage which is available to young, novice traders.

When asked by CNBC’s Kelly Evans about whether he might support a ban on Robinhood, Congressman Casten said that he will “punt” on that question, but that it comes back to regulators to look at new rules and “tightening up the law”.

Sean Casten is the representative in Congress for Illinois’s 6th congressional district, which includes the hometown of Robinhood trader Alex Kearns who committed suicide in June after seeing a negative balance of over $730,000 in his account.

The CNBC interview with Congressman Casten can be seen here: