Robinhood raises more money ($320M) at higher valuation ($8.6B)

The Robinhood train keeps a-chuggin’ along.

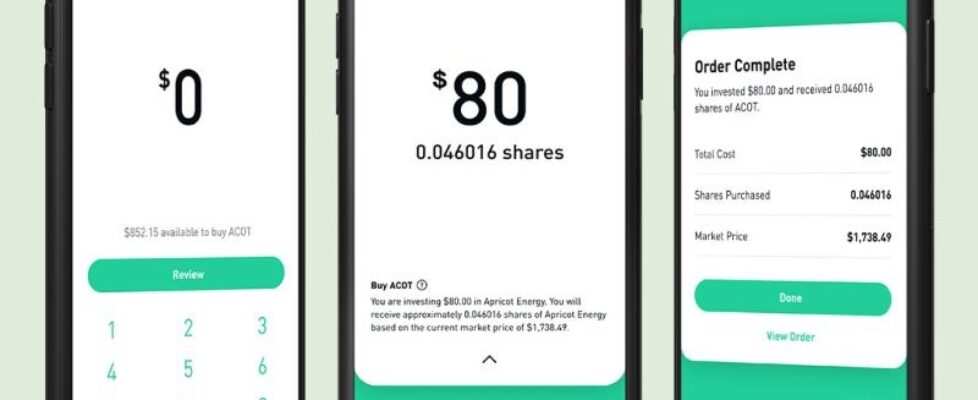

The online trading firm which single-handedly has shaken up the online trading market in the US and worldwide with its commission free offering and fractional share trading has raised an additional $320 million. The raise is part of Robinhood’s previously-announced, Sequoia Capital-led Series F funding round, but includes a few new investors in the company including late stage VC firm IVP, and consumer products focused investor TSG Consumer Partners.

The funding round also marks an increase in the private company’s imputed valuation, now at $8.6 billion, up slightly from $8.3 billion at last financing.

The company didn’t release any new operating info in conjunction with details of the additional financing. At the time the Series F was announced in May, Robinhood co-founder and co-CEO Vlad Tenev mentioned that the company has experienced a surge in trading volumes as new clients flocked to the Robinhood platform at the outset of the Coronavirus pandemic. At the time he said that Robinhood added three million funded accounts between January early May.

Robinhood suffered some negative headlines in recent weeks, as retail investors pouring money into shares of bankrupt car rental company Hertz – temporarily shooting its share price up from near zero to above $6 – were referred to as “Robinhood investors”. (Robinhood rival Public.com blocked its clients from trading Hertz shares). A 20-year-old Robinhood trader named Alex Kearns committed suicide in June after seeing a negative balance of over $730,000 in his Robinhood account, leading the company to look at providing more education and limits for its clients.