Robinhood manages to reduce net loss in Q4 2022

Robinhood Markets, Inc. (NASDAQ:HOOD) has announced its financial results for the fourth quarter and full year of 2022, which ended December 31, 2022.

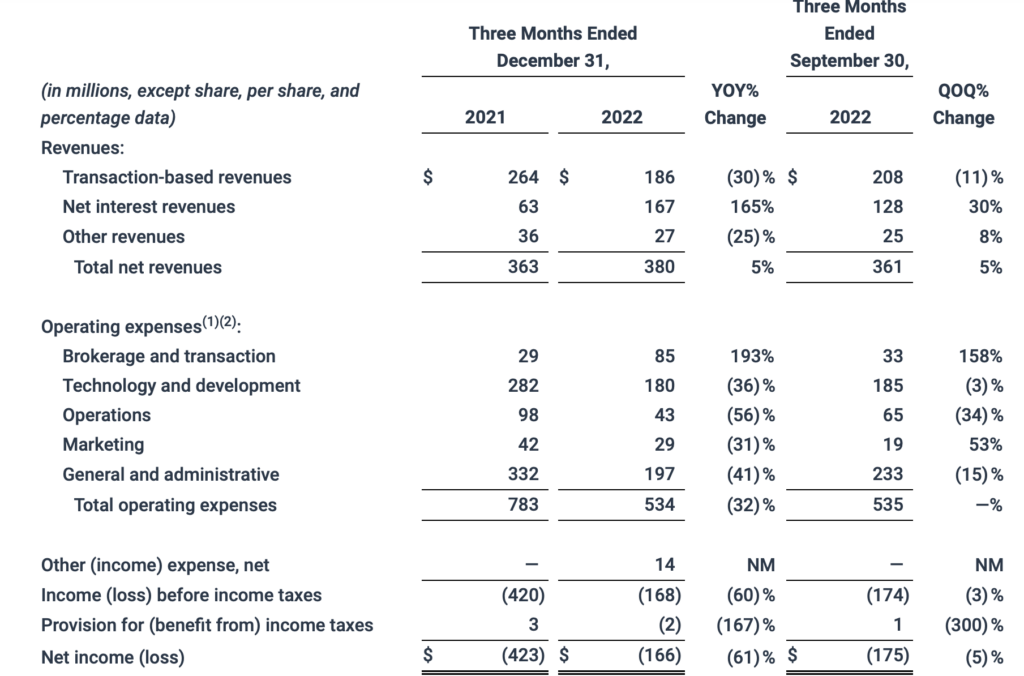

Net loss was $166 million, or earnings per share (EPS) of -$0.19, compared with net loss of $175 million, or EPS of -$0.20, in the third quarter of 2022, a sequential improvement of $9 million or $0.01 per share.

This includes a -$0.08 EPS impact from the combination of a $57 million loss from the Q4 2022 Processing Error (as defined), as well as a $12 million Ziglu equity security impairment.

Total net revenues increased 5% quarter-on-quarter to $380 million, whereas transaction-based revenues decreased 11% from the preceding quarter to $186 million.

Options were unchanged at $124 million while cryptocurrencies decreased 24% to $39 million. Equities decreased 32% to $21 million.

Net interest revenue increased 30% sequentially to $167 million, driven by higher short-term interest rates and growth in interest earning assets.

For full-year 2022, Robinhood reported total net revenues of $1.36 billion.

Net loss was $1.03 billion, or EPS -$1.17 per share.

Adjusted EBITDA (non-GAAP) was negative $94 million.

Vlad Tenev and Baiju Bhatt announced on Wednesday that they cancelled their 2021 pre-IPO market-based restricted stock unit awards which total 35.5 million of currently unvested shares.

This lowers Robinhood’s GAAP operating costs by up to $50 million per quarter starting in Q2, and it has already reduced the fully diluted share count by 3.5 percent.

Robinhood Board of Directors authorizes, subject to final approval, Robinhood to pursue purchasing most or all of the 55 million remaining Robinhood shares that Emergent Fidelity Technologies Ltd. bought in May 2022.

As a result of the progress Robinhood made on its cost reduction initiatives, including the reductions in force announced in April and August 2022 , the company expects:

- GAAP total operating expenses for full-year 2023 to be in the range of $2.375 billion to $2.515 billion.

- total operating expenses prior to share-based compensation for full-year 2023 to be in the range of $1.420 billion to $1.480 billion.

- share-based compensation for full-year 2023 to be in the range of $955 million to $1.035 billion.

This includes a one-time accounting charge related to the cancellation of founder share-based compensation in the first quarter of 2023, which is expected to be roughly $485 million. Robinhood expects the rest of the 2023 SBC to be in a range of $470 million to $550 million.