Robinhood introduces Robinhood Retirement

Starting December 6, clients of Robinhood will be able to sign up for Robinhood Retirement waitlist to invest for their future the Robinhood way. With Robinhood Retirement, customers are now able to open multiple Robinhood accounts for the first time.

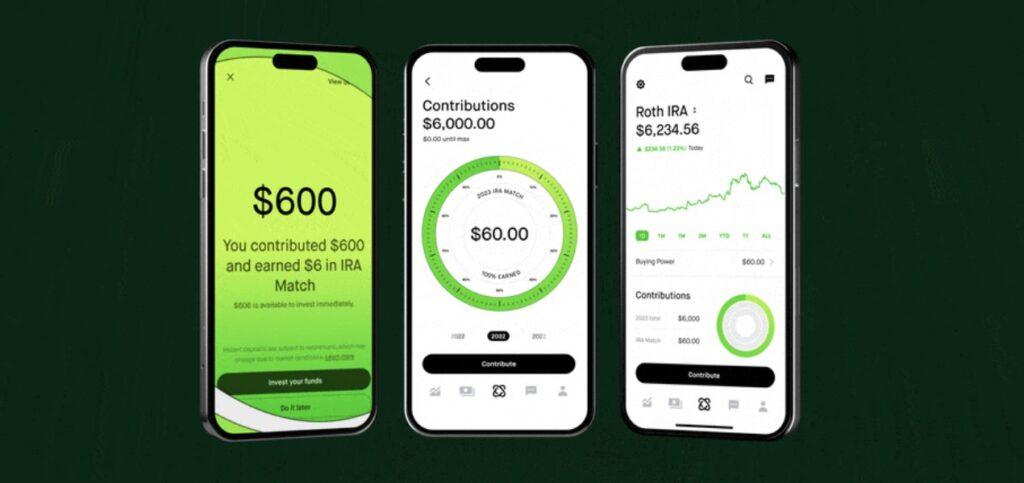

- Select your IRA. Customers can choose to invest in stocks and ETFs through either a traditional IRA or Roth IRA.

- Invest on your own terms. Robinhood’s retirement account lets customers build a custom portfolio through its tailored in-app recommendations, by choosing their own investments, or a mix of both. The sign-up process and onboarding flow takes a few minutes and helps customers get started right away.

- Instant Deposit – Once a customer contributes, they will have access instantly to their funds to start investing, up to $1,000.

With Robinhood Retirement, earnings can grow either tax-free or tax-deferred, which means customers will save on taxes while saving for their future – an added tax benefit even if they already have a 401k elsewhere.

Starting December 6, people can sign up to apply for early access via a waitlist and will receive access on a rolling basis over the following weeks, with full availability in January. For customers who want early access sooner, Robinhood has developed a referral program. Customers have the ability to refer a friend to the Retirement waitlist and once their friend joins, they will receive early access to a retirement account.