Retail FX broker ForexCT has ASIC license cancelled

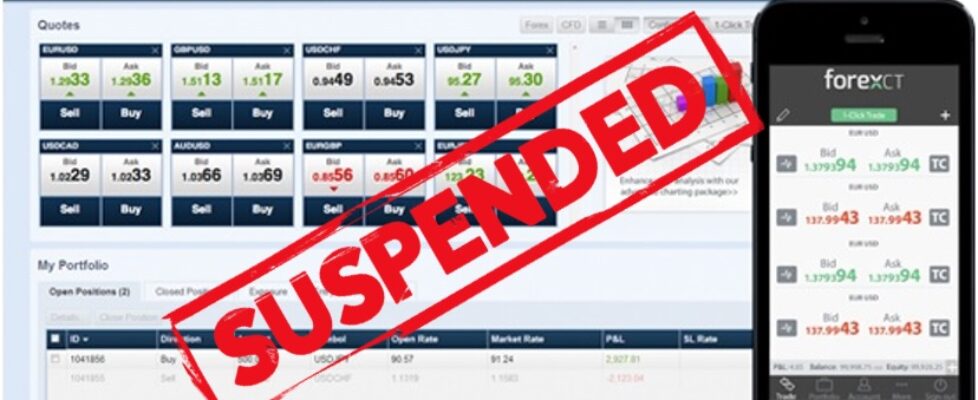

Australian financial regulator ASIC has cancelled the AFS license of an active retail FX and CFDs broker, ForexCT (website at forexct.com.au).

The company now has a notice posted on its site (see image below):

Important Notice

From 28 May 2020, ForexCT is no longer accepting new customers.

If you are an existing customer with ForexCT, we have sent you an email which sets out the limited basis on which ForexCT continues to operate. As set out in that email, ForexCT will only accept orders to close existing open positions and customers will not be permitted to establish new open positions. We encourage all clients to take steps to close out existing positions as soon as practicable prior to 5PM AEST on Friday 26 June 2020 as our trading platform will be decommissioned and no longer accessible from that time.

It appears that the Australian website will indeed be (eventually) taken down by ForexCT, but the company also actively operates an offshore site at forexct.com, so it looks like ForexCT will continue operating as an offshore broker. That offshore entity, which doesn’t show where it is domiciled but has a UK telephone number on its Contact Us page, claims to be run by a company called Forex Capital Trading Ltd.

ForexCT was originally sanctioned by ASIC back in March 2019. Although no action was taken with regards to its license at the time, ASIC put a restraining order on ForexCT, barring it from transferring money outside the country. That restraining order was amended to allow it to transfer money to clients overseas, but only on a case-by-case basis with each instance requiring approval by ASIC.

In making its decision, ASIC cited a number of reasons including ForexCT disregarding key obligations, unconscionable conduct, misleading and deceptive conduct, a failure to manage conflicts of interest, lacking sound ethical values in dealing with clients, and a failure to ensure its representatives were adequately trained.

The full text of ASIC’s cancellation notice for ForexCT’s license follows.

Friday 5 June 2020

20-128MR ASIC cancels licence of retail OTC issuer Forex Capital Trading Pty Ltd

ASIC has cancelled the Australian financial services (AFS) licence of retail over the counter (OTC) derivative issuer Forex Capital Trading Pty Ltd (Forex CT).

Forex CT offered clients opportunities to trade in contracts-for-difference (CFDs) and margin foreign exchange contracts (FX Contracts).

ASIC cancelled Forex CT’s AFS licence after its investigation found Forex CT’s financial services business model disregarded key obligations of an AFS licensee and resulted in unconscionable conduct, misleading and deceptive conduct and a failure to manage conflicts of interest.

ASIC’s investigation also found that Forex CT lacked sound ethical values and judgement in dealing with clients, failed to ensure its representatives were adequately trained and complied with financial services laws and failed to ensure that financial services covered by its licence were provided efficiently, honestly and fairly.

CFDs and FX Contracts are OTC derivatives that allow clients to speculate on the change in the value of an underlying asset. ASIC’s investigation identified a number of clients incurring large losses in the hundreds of thousands of dollars, including from their superannuation accounts, from investing in these products.

‘ASIC continues to focus on conduct by AFS licensees who operate business models that harm consumers,’ ASIC Commissioner Cathie Armour said.

Forex CT’s AFS licence will continue until 31 July 2020, for the purpose of having a dispute resolution scheme in place to resolve any disputes with the Australian Financial Complaints Authority. Forex CT’s license will also continue until 31 July 2020 to facilitate the orderly closure of existing client positions. Forex CT is not permitted to open new client positions. Forex clients can contact Forex CT in relation to the closure of current open positions.

Forex CT has the right to appeal to the Administrative Appeals Tribunal for a review of ASIC’s decision.

Background

Forex Capital Trading Pty Ltd traded under AFS licence 306400

On 19 March 2019, ASIC obtained orders in the Federal Court restraining Forex CT from transferring any property, including client money, overseas. The orders restraining Forex CT from transferring property overseas were subsequently amended requiring Forex CT to seek ASIC approval in writing prior to making any overseas payments and extended by consent until 5pm on 24 July 2020.

The size of the Australian market for OTC retail derivatives has grown considerably over recent years. With that growth, there has been a dramatic increase in complaints to ASIC in relation to conduct within the OTC retail derivatives market.

On 6 May 2020, ASIC published Retail investor trading during COVID-19 volatility, The paper identified that trading activity in CFDs has increased significantly during this period of heightened volatility. Leverage inherent in CFDs magnifies investment exposure and sensitivity to market volatility, so retail clients should be particularly cautious about investing in leveraged products at this time.

For many years, ASIC has taken strong regulatory action to protect consumers of retail OTC derivatives, using a range of regulatory tools, including:

- enforcement action to address instances of misconduct;

- public warning notices and other statements;

- surveillance projects and thematic reviews;

- stronger regulations; and

- extensive retail client education campaigns and guidance for issues of retail OTC derivatives.

ASIC is considering feedback on its proposals in Consultation Paper 322 Product intervention: OTC binary options and CFDs (CP 322). ASIC consulted on making market-wide product intervention orders to address concerns about significant detriment to retail clients from trading OTC binary options and CFDs.

Important Notice

Important Notice