NAGA reports profitable start to 2023 on strong copy trading activity

Social and copy trading focused online broker NAGA Group AG (ETR:N4G) has issued a brief trading update, indicating that the company’s cost cutting efforts have helped it begin 2023 profitably.

After FNG analysis revealed that NAGA Revenues fell by 43% to €20 million for the last six months of 2022 closing out a money-losing year (note that NAGA has not yet released its official FY2022 results), NAGA has indicated that year-to-date the company generated group Revenues of close to €6 million (which we assume covers the first six weeks of 2023), whilst expenses were kept at around €4.5 million.

Following a restructuring in the summer of 2022, NAGA decreased its cost base compared to the start of 2022 in 2023 by more than 65% whilst keeping new customer growth 15% above 2022 levels.

NAGA – which operates CySEC licensed site nagamarkets.com and offshore site naga.com – said that Active Users on a 3 months view are at all time high, as is monthly trading activity. Copy trading represents 55% of overall trades whilst 2023 customer deposits compared to the same period in 2022 are up by 50% and average deposits per new client are up by 75%.

Interestingly, the trading update made no mention or update on NAGA’s recent announcement that it was in discussions on a merger with a “multi-country brokerage firm.”

The group said it continues to improve its marketing efficiency by developing further automation and business intelligence technology as well as preparing the expansion into the Southeast-Asia and Latin America regions with its newly established offshore Seychelles entity NAGA Capital.

“We are pleased to see that our restructuring efforts are materializing,” says Benjamin Bilski, CEO and founder of NAGA Group AG, assessing the successes achieved at the beginning of the year. “We kept new user growth up whilst cutting overall operating expenses significantly. Our acquisition cost per user has improved by over 75% and the value per user went up by another 13% year over year. We keep improving the current operation and preparing ourselves for more global business from the emerging markets, which we see as a significant profit driver in 2023.”

About NAGA

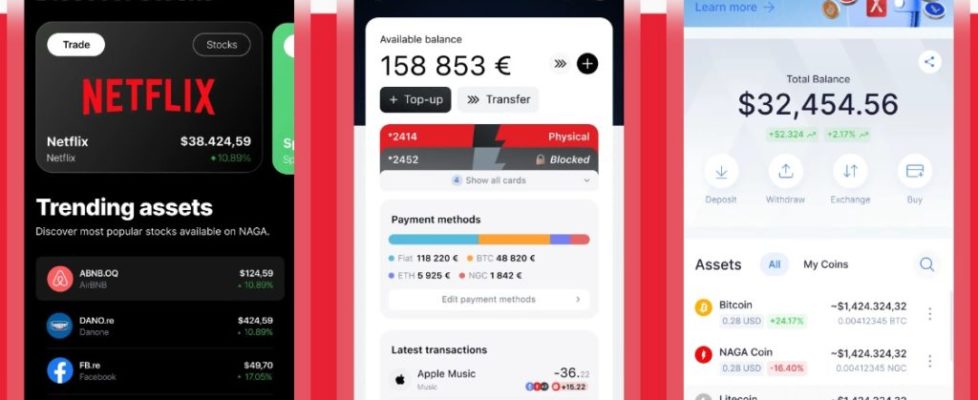

NAGA is an innovative fintech company that seamlessly connects personal finance transactions and investments through its social trading platform. The company’s proprietary platform offers a range of products from stock trading, investments and cryptocurrencies to a physical VISA card. Additionally, the platform allows for exchanges with other traders, provides relevant information in the feed, and autocopy features for successful members’ trades. NAGA is a synergistic total solution that is easily accessible and inclusive. It provides an improved foundation to trade, invest, network, earn and pay. This applies to both fiat and crypto products.