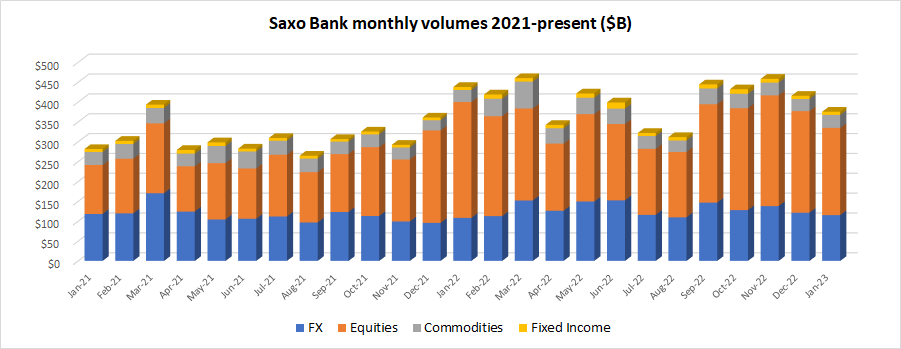

Saxo Bank begins 2023 slowly, January volumes -18% MoM

Copenhagen based Retail FX and CFDs broker Saxo Bank has apparently started 2023 off on the wrong foot, reporting a significant client trading volume decline from what was a slow December.

Total multi-asset volumes at Saxo Bank came in at $375.6 billion for January 2023, down 18% from December’s $415.7 billion – and marking Saxo’s slowest month since August 2022. In 2022 Saxo Bank averaged $405 billion in monthly client trading volume.

Leading the decline was a 21% slowdown in Equities trading to $219.7 billion, and a 17% decline in FX trading to $115.2 billion.

We reported in mid January that Saxo Bank was now eyeing a traditional IPO in its home market (Nasdaq Copenhagen) following its failed attempt last year to go public via a SPAC merger. However a decline in trading activity, if it continues, would certainly harm that effort, and/or lead to a lower valuation for the company, whose largest shareholders seeking to exit are China’s Geely Group and Finland’s Sampo.