NAGA Group shares tumble 4% after posting 2020 results, 2021 outlook

Shares of social trading focused Retail FX and CFDs broker NAGA Group AG (FRA:N4G) fell by 4% on Tuesday, after the company released its results for 2020 and a somewhat less-than-thrilling outlook for 2021.

First to the numbers… NAGA Group, which operates the CySEC-licensed NAGA.com site, stated that in 2020 the company brought in a total output (their word for Revenues) of EUR 26.3 million (previous year: EUR 8.4 million), NAGA achieved the turnaround in the record year 2020 with platform trading revenues of EUR 24.3 million (previous year: EUR 5.6 million), a group EBITDA of EUR 6.6 million (previous year: EUR -9.2 million) and a consolidated annual net profit of EUR 2.0 million (previous year: EUR -13.4 million loss).

While 2020 was much improved over 2019 at NAGA – and NAGA’s share price responded by rising more than 600% in calendar 2020 – the company stated that the Management Board confirms the group sales forecast issued at the beginning of the year of an increase to EUR 50 million to EUR 52 million, and a group EBITDA of EUR 13 million to EUR 15 million.

After an already-reported Q1-2021 at NAGA with Revenue at USD 13.7 million and EBITDA of USD 3.7 million, it seems as though the stay-the-course forecast somewhat disappointed the market, which was expecting continued growth. (Q1 was reported before full-year 2020 results as the full-year results need to be audited, which took more time this year due mainly to COVID related issues, more on that below).

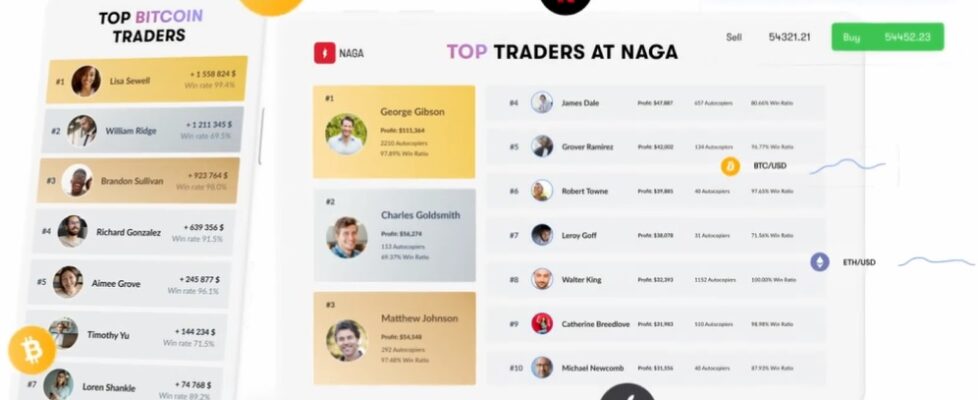

The company added that management’s strategy to market NAGA globally through increased investments in marketing and sales and the focus on customer support and platform quality has led to significant growth. As of December 31, 2020, the number of customers increased by 72% to 43,646. The number of active users more than doubled, while the number of transactions rose by 117% to over 6.3 million and the trading volume tripled to EUR 120 billion. Another highlight is the strong increase in transactions resulted primarily from copy trading. More than 1.7 million trades were copied at NAGA in 2020, which corresponds to a growth of more than 142%.

In 2021, NAGA said that it is accelerating its investments specifically in marketing, sales and geographic expansion in order to increase awareness of the NAGA group of companies and their innovative products. In addition to existing branches in Cyprus, China, Thailand and Nigeria, NAGA is aiming to start business in Australia, South Africa and Vietnam this year, after licensing. In the coming quarters, NAGA said it will announce further product updates in order to further improve the platform quality and user experience, alongside the go-live of its payment app NAGA Pay.

The company also informed about a delay in regard to the completion of the audit and the publication of the 2020 consolidated financial statements. The background are primarily COVID-19-related delays in the preparation and audit of the annual financial statements in Cyprus, which was classified as a high-risk area for several months during the audit period. This made it considerably more difficult to carry out the on-site visits required as part of the audit. The Management Board expects to publish the 2020 consolidated financial statements in the course of July and assures that this is purely a process-related delay and not an audit-related delay.

NAGA Group shares are still up 47% on the year, but at €5.95 have fallen by 36% since hitting an all-time high of €9.30 in early February.

NAGA Group AG shares, 2021 year-to-date. Source: Google Finance.