NAGA adds Visa debit card, pursuing crypto license

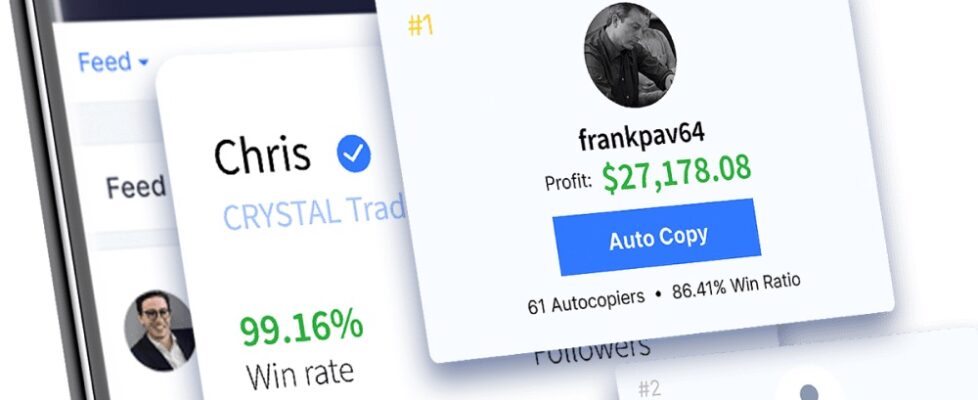

Social trading focused Retail FX brokerage firm NAGA Group AG (FRA:N4G) has announced the launch of its payments platform NAGA Pay, with UK/EEA payments and VISA Debit Card. NAGA’s program will offer users the opportunity to link and access funds held directly in their payment and brokerage wallets as well as their physical crypto-wallets, the latter being subject to licensing later in Q4 (more on that below).

NAGA said that it is yet again delivering on its promise of designing and deploying disruptive products that users can apply to better the way with which they interact concerning their funds and investing decisions. NAGA Pay will offer direct payment services supported by all asset classes available on the NAGA Trading Platform. The all-new NAGA Pay app is powered by Contis, one of Europe’s leading providers of payments solutions to FinTechs and financial institutions. Via Contis, NAGA gains access to the UK and EEA payment rails, as well as adding a globally recognized VISA Debit Card accepted with over 140 million merchants worldwide.

The delivery of the first personal accounts is expected by Q3 2021, subject to receiving all regulatory approvals.

NAGA shares traded up about 5% on the news, although at €5.91 they are significantly lower than their 52-week (and all-time) high of €9.30 set earlier this year in February.

Benjamin Bilski, CEO of NAGA, said:

“Our first NAGA card offering suffered from technical limitations and did not meet all our customers’ needs. In choosing to work with Contis, we’ve gained a strong and highly experienced partner with a documented track record and industry leadership. Contis brings a proven ability to deliver large scale payment solutions that enable the advanced conversion of invested assets to fund fiat transactions in real time at the point of sale.”

The NAGA Pay and VISA Debit Card will allow users to utilize their active portfolio investments, converting instantly to fiat at the point of sale by utilizing the award winning Contis buffer-technology. Transactions are immediately funded in real-time using the users’ available assets’ value on the NAGA platform. At checkout, users can opt whether their personal account or their active stocks & shares portfolio should fund their card transaction, with a simple selection on their app. For example, a customer with a credit balance of EUR500 on NAGA Pay and EUR500 in Apple shares can decide which asset is selected for a payment using their VISA Card.

Subject to licensing its crypto and blockchain division later in the year, NAGA plans to add cryptocurrencies as a payment option and an addition to the buffer.

NAGA Pay will offer a fully digital account opening process and will be offered as either a standard Free or Premium (EUR 4.99 per month) solution. The premium account will have lower fees for withdrawals, dedicated offers, premium customer support and higher limits for transactions.

NAGA added that it plans to fully license its cryptocurrency and blockchain division, and has hired a dedicated and specialized team to that effect. The company did not say in which jurisdiction it would seek such a license. NAGA is based in Hamburg, Germany but operates its NAGA.com website under a CySEC CIF license from Cyprus.

“Crypto is here to stay and will. We do believe however, that regulation and licensing will be a major factor for all players in the future. Given our expansion into payments and our plans to allow instant cryptocurrency spending as well as the rising demand by our clientele for spot-crypto, we started the process of obtaining proper licensing for our crypto products as well as hired a dedicated Team to improve and expand our cryptocurrency offering at NAGA”, adds Bilski.