Interactive Brokers reports rise in revenues in Q3 2024

Update: On October 22, 2024, IBKR issued the following update:

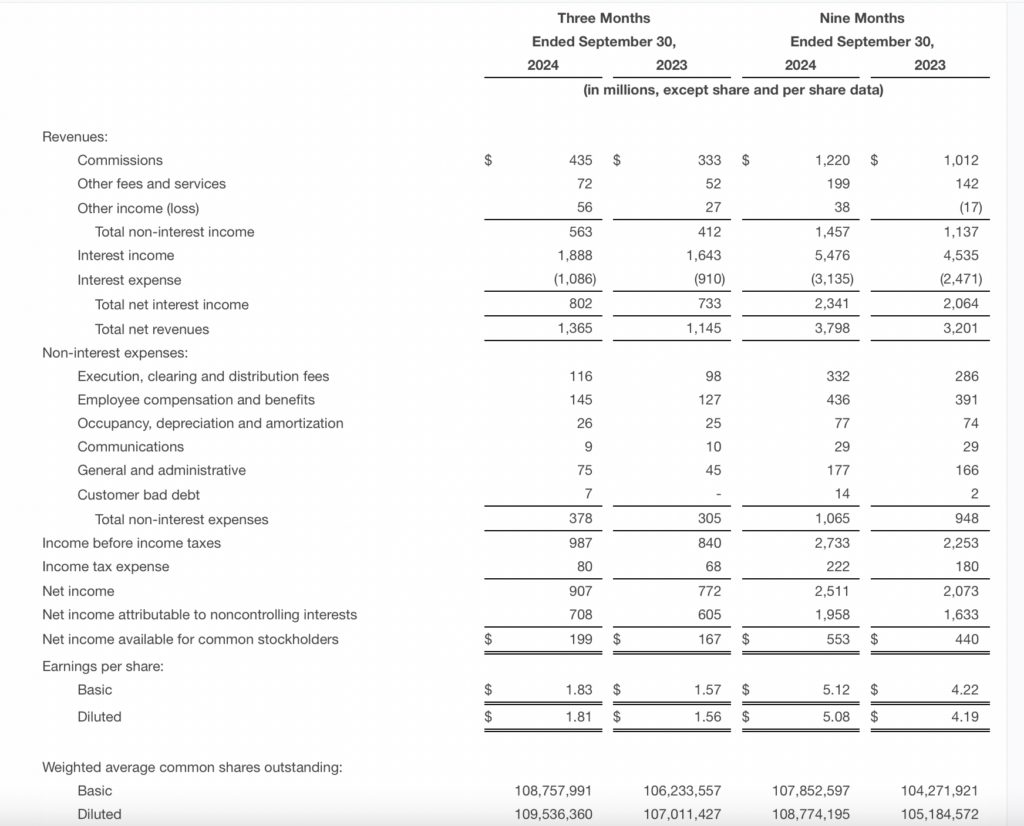

Subsequently, Interactive Brokers LLC reached agreements in principle to settle certain disputes which relate back to events that took place prior to the end of the quarter ended September 30, 2024. The settlement will add $78 million to reported general and administrative expenses for the quarter ended September 30, 2024, and will result in the following revised operating results for the Company:

-

General and administrative expenses: $153 million

-

Income available for common stockholders: $184 million

-

Adjusted net income available for common stockholders: $176 million

-

Diluted earnings per share: $1.67

-

Adjusted diluted earnings per share: $1.61

-

Total equity: $16.0 billion

Interactive Brokers Group, Inc. (NASDAQ:IBKR), an automated global electronic broker, has announced its financial results for the quarter ended September 30, 2024.

For the third quarter of 2024, the company reported diluted earnings per share of $1.81. This is up from diluted earnings per share of $1.56 registered in the year-ago quarter.

Reported net revenues were $1,365 million for the current quarter and $1,327 million as adjusted. For the year-ago quarter, reported net revenues were $1,145 million and $1,139 million as adjusted.

Commission revenue increased 31% to $435 million on higher customer trading volumes. Customer trading volume in options, stocks and futures increased 35%, 22% and 13%, respectively.

Reported income before income taxes was $987 million for the current quarter and $949 million as adjusted. For the year-ago quarter, reported income before income taxes was $840 million and $834 million as adjusted.

Net interest income increased 9% to $802 million on higher customer margin loans and customer credit balances.

General and administrative expenses increased $30 million, or 67%, to $75 million, driven primarily by a one-time charge of $12 million related to the consolidation of Interactive Brokers’ European subsidiaries and a $9 million increase related to legal and regulatory matters.

Pretax profit margin for the current quarter was 72% both as reported and as adjusted. For the year-ago quarter, pretax margin was 73% both as reported and as adjusted.

The Interactive Brokers Group, Inc. Board of Directors declared a quarterly cash dividend of $0.25 per share. This dividend is payable on December 13, 2024, to shareholders of record as of November 29, 2024.

Customer accounts increased 28% to 3.12 million, whereas customer equity increased 46% to $541.5 billion.

Total daily average revenue trades (DARTs) increased 42% to 2.70 million.